From expanding our physical footprint and product portfolio, to showing up consistently for merchants, partners, and the wider fintech community, 2025 was about doing the work. And doing it with purpose.

Here’s our year, wrapped.

Launching our new brand

2025 was the year we formalised payabl.’s new positioning and brought it to life through a refreshed brand.

Built around the idea of making money flow, the rebrand clarified what merchants can expect from payabl. Simplicity where there was complexity, reliability where there was uncertainty, and technology designed to support real business outcomes.

This evolution went beyond visual identity. It sharpened how we communicate value, how we frame our products, and how we demonstrate value to our partners.

The new positioning is anchored in clarity, consistency, and customer-centric innovation, and it will continue to guide how we build and scale in 2026.

Showing up across Europe, and beyond

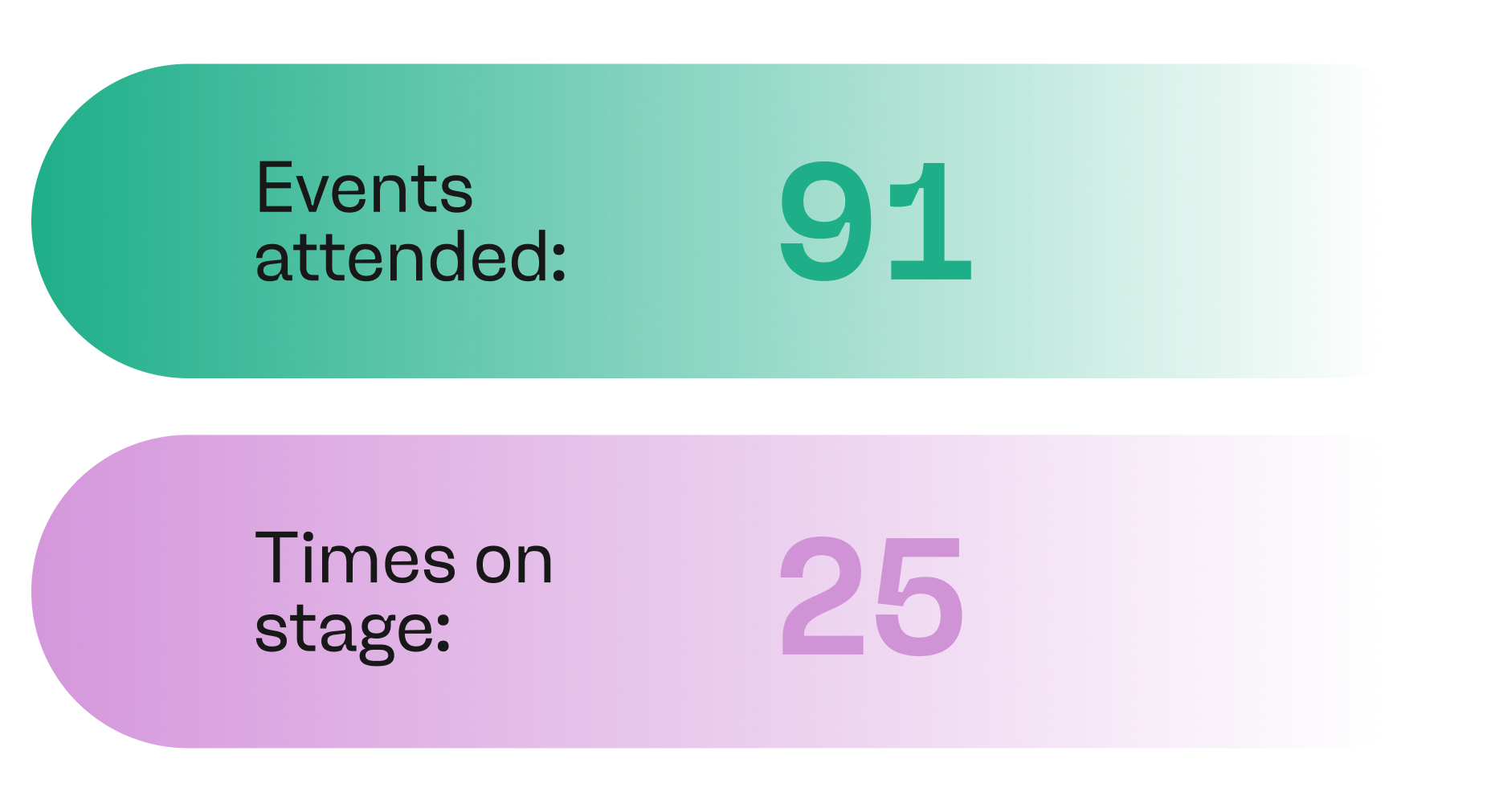

In 2025, we attended 91 events; meeting merchants, partners, and industry peers face to face. Our footprint across Europe grew, and so did our client base and solution set.

These weren’t just box-ticking appearances. They were conversations about growth, regulation, customer experience, and the practical realities of payments at scale.

We also took to the stage more than 25 times, contributing to industry dialogue across flagship global conferences and regional forums, including Money20/20 Europe, Web Summit in Lisbon and Qatar, iFX Expo Cyprus, Merchant Payments Ecosystem in Berlin, Merchant Risk Council in Barcelona, Pay360, SBC Lisbon, Reflect Festival, Cyprus Diaspora Forum, FMLS, Mare Balticum Game and Tech Summit, Ecommerce Expo London, Women in STEM CY, and multiple FinPro meetups and TechIsland events.

Across these platforms, our focus was consistent. Practical insight and solving real-world merchant challenges.

Scaling the platform

2025 was a year of meaningful product expansion and integration.

We strengthened and broadened our suite of solutions with several launches and enhancements that support merchants at every stage of commerce.

In the UK, we brought payabl. in-store payments live, enabling fast, reliable, and secure point-of-sale acceptance for omnichannel merchants.

SEPA Direct Debit expanded our platform to support recurring euro collections, giving businesses greater flexibility for subscriptions and supplier payments.

Virtual business cards empowered businesses with instant digital cards, smarter spending controls, and improved expense visibility.

We also launched native integrations with Shopify and PrestaShop, enabling merchants on both platforms to access streamlined onboarding and seamless payment acceptance. Each launch was guided by a simple principle. Payments should remove friction, not introduce it.

Industry recognition

In 2025, our work was acknowledged across the industry, with wins and shortlists that reflected both product strength and leadership vision.

Highlights included Best payment service provider at the FMLS awards, platinum for virtual cards innovation at the Juniper Research future digital awards, three awards at The Payments Awards, and PayTech leadership visionary CEO at the PayTech awards.

Alongside these wins, payabl. was shortlisted across multiple categories at the Payments Awards, Cards and Payments Awards, Retail Systems Awards, RTIH Innovation Awards, FF Awards, SBC Awards, and FStech Awards. These spanned merchant acquiring, fraud and compliance, alternative payments, innovation, and leadership.

The breadth of this recognition mattered. It reflected a platform and a team operating across the full payments lifecycle.

Partnerships that extend capability

Strong ecosystems are built through collaboration. In 2025, we deepened and expanded key partnerships across commerce, finance, and fraud prevention.

These included Shopify, Wero (EPI), PrestaShop, ClearBank, and Sift.

Together, these partnerships strengthened our ability to serve merchants with integrated, future-ready solutions from checkout to compliance.

Sharing insight

We continued to invest in content designed to solve real merchant challenges. As payments become more complex, merchants need clarity on what actually impacts conversion, cost, and customer experience.

This year, we launched How Europe likes to pay, The state of European checkouts report, a Black Friday eBook, and the second season of the Pay it forward podcast. These resources address some of the most common pain points merchants face, from fragmented payment preferences across markets to checkout drop-off, seasonal demand spikes, fraud pressure, and operational inefficiency.

Each piece of content combines data, market insight, and practical guidance, helping merchants benchmark their performance, understand where friction exists in their payment journeys, and make informed decisions about where to invest next.

Next year, our merchants can expect increased granularity per industry, even more market data, and actionable strategies to keep ahead of the competition.

Growing our footprint

In January, we opened a new London office to support our expanding UK presence. Our London team is now close to 30 strong, with plans to significantly scale further in 2026.

In September, we formally established our Vilnius office with the registration of a local entity. This reinforced our long-term commitment to Lithuania and positioned Vilnius as payabl.’s hub for the Baltics and Nordics.

Supporting the community

Community support remained a consistent thread throughout the year. Within fintech, we continued our close collaboration with Work in Fintech, contributing to ecosystem development and talent visibility.

In sport, we supported teams and initiatives that reflect discipline, teamwork, and ambition, including London Lions, Zalgiris, the Neofytos Chandriotis basketball tournament, and our role as official payments partner of Anorthosis Famagusta FC.

These partnerships go beyond branding. They reflect our belief that strong communities and strong payment systems are built through long-term commitment.

On that note, watch out for our team of payabl.er’s taking on Hawaii Ironman 70.3 in 2026, the ultimate test in commitment, balance, consistency, and adaptability.

Closing the year, looking ahead

2025 was not about one big moment. It was about consistency. Turning up and earning trust. Building the technical, human, and cultural foundations for the future.

As we look towards 2026, the focus remains the same. Making money flow, so businesses can focus on growth. Thank you to our merchants, partners, and teams for being part of the journey.