fraud prevention, powered by AI '%20d='M42.8667%200H9.84112C5.15994%200%20.75225%203.14009.0927%207.69163-.69554%2013.2423%203.64781%2018%209.13331%2018H42.1589c4.6812%200%209.0889-3.1401%209.7484-7.6916C52.6955%204.75771%2048.3522%200%2042.8667%200Z'/%3e%3cdefs%3e%3clinearGradient%20id='a'%20x1='59.4197'%20x2='9.19766'%20y1='9.00793'%20y2='9.00793'%20gradientUnits='userSpaceOnUse'%3e%3cstop%20stop-color='%237CDDAE'%20stop-opacity='0'/%3e%3cstop%20offset='.41'%20stop-color='%237CDDAE'%20stop-opacity='.44'/%3e%3cstop%20offset='.82'%20stop-color='%237CDDAE'%20stop-opacity='.84'/%3e%3cstop%20offset='1'%20stop-color='%237CDDAE'/%3e%3c/linearGradient%3e%3c/defs%3e%3c/svg%3e)

Stop fraud in its tracks without compromising user experience.

Why choose payabl. for fraud prevention?

Fraud isn’t just a threat—it’s a growth barrier. We remove it.

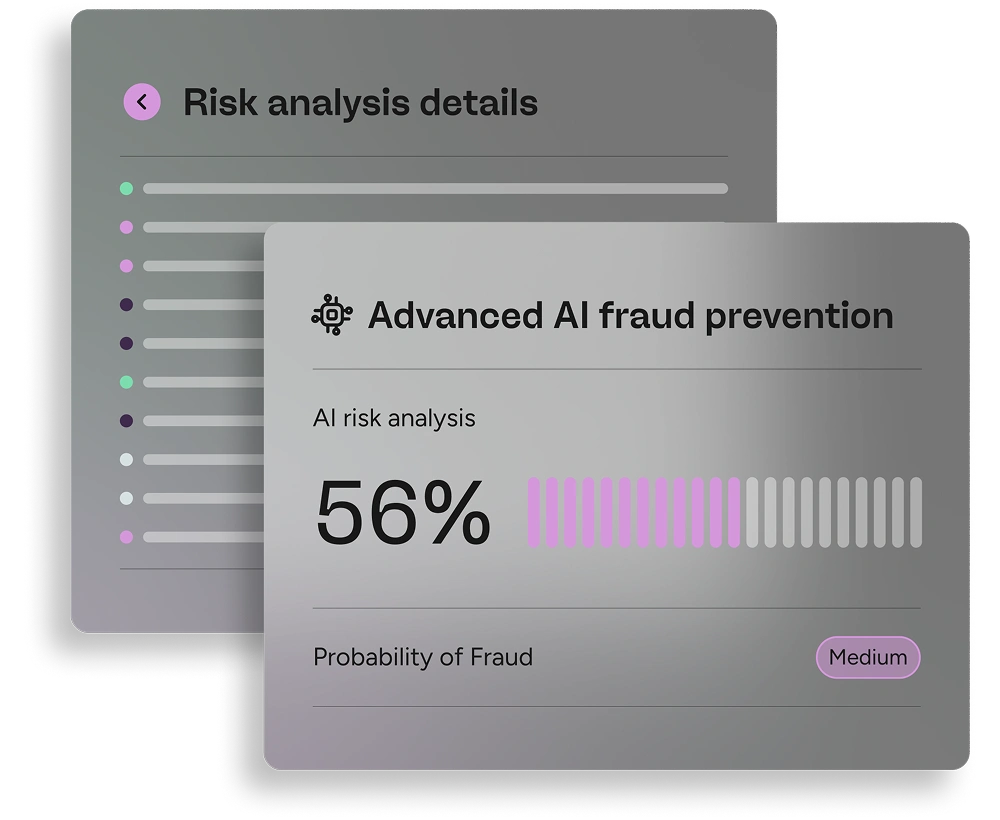

AI-powered decision-making

Every transaction benefits from enterprise-grade intelligence—thanks to our partnership with Sift. The result? Smarter approvals, stronger protection, seamless experiences.

Fewer chargebacks, fewer false declines

Stop fraud without blocking your best customers. Our intelligent systems distinguish bad actors from real buyers—boosting approval rates and customer trust.

Stronger compliance, more conversions

Maximise your eligibility for TRA exemptions and meet evolving SCA and PSD2 requirements—with less friction and more confidence.

Seamless, invisible defense

Fraud protection runs quietly in the background. Your customers won’t notice, but your bottom line will.

Around-the-clock support

Our Risk team works 24/7, combining human insight with AI speed to stay ahead of fraud threats.

Fraud facts

€6.3 billion

Payment losses to fraud reported across the EEA between 2022 and mid-2023.*

44%

European consumers that expect fraud prevention to be handled by payment providers—not by them.**

AI-driven fraud tools

Reduce false positives and manual reviews, while increasing approval rates.***

*European Central Bank & EBA joint report

**payabl. State of European Checkouts

***Sift internal benchmarks

How we keep you and your customers safe

How it works

Evaluate

Transactions are instantly assessed by Sift’s machine learning engine.

Analyse

Risk signals from device, behaviour, geography are analysed in real time.

Approve

Safe transactions are approved seamlessly with high-risk blocked or flagged.

Manage

You manage exceptions and disputes from your payabl.one dashboard.

Want to reduce chargebacks in every market?

Get started