recurring payments that flex to you '%20d='M42.8667%200H9.84112C5.15994%200%20.75225%203.14009.0927%207.69163-.69554%2013.2423%203.64781%2018%209.13331%2018H42.1589c4.6812%200%209.0889-3.1401%209.7484-7.6916C52.6955%204.75771%2048.3522%200%2042.8667%200Z'/%3e%3cdefs%3e%3clinearGradient%20id='a'%20x1='59.4197'%20x2='9.19766'%20y1='9.00793'%20y2='9.00793'%20gradientUnits='userSpaceOnUse'%3e%3cstop%20stop-color='%237CDDAE'%20stop-opacity='0'/%3e%3cstop%20offset='.41'%20stop-color='%237CDDAE'%20stop-opacity='.44'/%3e%3cstop%20offset='.82'%20stop-color='%237CDDAE'%20stop-opacity='.84'/%3e%3cstop%20offset='1'%20stop-color='%237CDDAE'/%3e%3c/linearGradient%3e%3c/defs%3e%3c/svg%3e)

No more missed payments. Automate your billing with a secure, pre-authorised recurring payments solution—and enjoy on-time payouts. Subscription payment processing models can drive 35–45% higher retention rates.*

*Source: McKinsey

Why offer recurring billing?

Give your customers a regular way to pay, while you enjoy predictable revenue growth through an optimised provider’s recurring payment system.

Predictable cash flow

Track your revenue effortlessly with unified reporting. Build forecasts across all payment types and payment processors.

Collect payments on your schedule

Align collection dates with your business needs. Pre-notification and built-in mandate management ensure reliable, compliant payment collection. Precisely tailor payabl.’s subscription payment solutions and recurring payments service with fewer failed payments.

Low-cost processing with no interchange fees

Make your subscription management platform work for you. Alternative payments reduce transaction costs and improve profitability. Choose a subscription payment platform with integrations and add ons that increase cost savings.

Fast deployment and an easy integration

Launch your subscription business quickly with a low-code subscription payment gateway setup that simplifies ongoing technical upkeep and revenue recognition, so you can focus on maximising the value of the customer experience and customer lifecycle.

Built for subscription-first pricing models

A subscription payment provider like payabl. is ideal for convenience, consistency, and customer loyalty.

How it works

Power flexible payment models via a payment gateway for subscriptions. payabl.'s subscription-based payment gateway manages different variables, like billing frequency or usage-based billing.

After your customer selects their preferred payment method, you can manage subscriptions in your billing system in three easy steps:

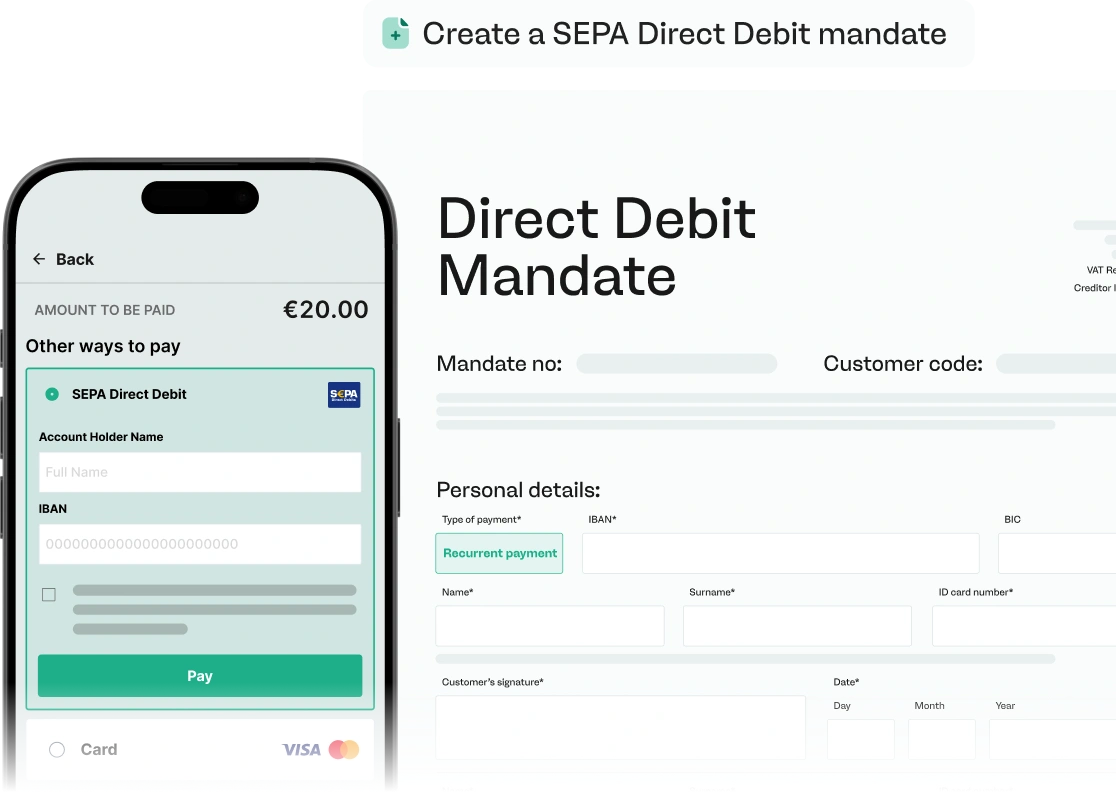

Customer authorisation

Your customer provides their bank and payment details to authorise fund retrieval.

Create mandate

Set up payment schedules or one-off collections with pre-notifications as payment reminders from us.

Payments collected

Transactions are sent on agreed-upon due dates and settled to your account.