The Single Euro Payments Area (SEPA) allows customers to make cashless payments across the European Union. Introduced first in 2008 for credit transfers, SEPA enabled direct debits in 2009 and reached full implementation across the EU in 2014.

What does SEPA Direct Debit mean?

SEPA Direct Debit (or SEPA DD for short) is a payment method that enables businesses to collect and process payments directly from a customer’s bank account. Unlike traditional direct debits, SEPA direct debit payments can be used for cross-border transactions across the entire Euro area.

How do SEPA Direct Debit transactions work?

SEPA direct debit payments are bank-to-bank, eliminating payment cards from the process entirely. To offer SEPA direct debit transactions as a payment method, you will need to receive a SEPA DD mandate from the customer, which allows you to collect funds directly from their account. SEPA DD is particularly useful for recurring payments, such as subscription services or utility bills. The mandate only requires an initial approval, after which your business can automatically collect future payments on a recurring basis without the need for manual authorisation each time.

Breaking down the SEPA DD process:

→ The payer (customer) selects SEPA Direct Debit as their payment method at checkout.

→ The merchant’s payment system redirects the customer to the mandate form. This includes a request for the customer’s International Bank Account Number (IBAN) and Bank Identifier Code (BIC), which is typically provided by the bank after authorisation from the customer.

→ The payer easily signs either a paper or electronic mandate and returns it to the merchant.

→ With the mandate in place, the merchant’s bank can then collect a payment directly from the customer’s bank account without any additional action from the customer or merchant themselves.

Types of SEPA Direct Debit: Core vs B2B

The SEPA Direct Debit payment scheme is divided into two main payment rails known as SEPA Direct Debit Core and SEPA Direct Debit B2B.

| Key differences | SEPA Direct Debit Core | SEPA Direct Debit B2B |

|---|---|---|

| Who’s involved? | Consumers and businesses | Only businesses |

| Refund Rules | Consumers may request a refund within 8 weeks of the transaction and up to 13 months of an unauthorised transaction.

| Unlike SDD Core, SDD B2B does not include a refund right for authorised transactions due to the large payment amounts, requiring businesses to perform additional mandate verification steps. |

| Mandate Requirements | Customers sign a mandate that includes details like the payment amount and frequency. SEPA DD Core mandates are available to all individual consumers with a bank account in a SEPA country. | When handling SEPA DD B2B mandates, the paying business must take an extra step by authorising the mandate with their bank directly. These extra precautions help protect against fraud. |

| Who Should Use It? | SEPA DD Core is a suitable payment method for any business accepting payments from consumers. Common examples include utility bills, subscription services, and memberships. | Businesses engaging with other businesses for the exchange of goods and services within the SEPA zone. Common examples include service agreements and supplier payments. |

SEPA Direct Debit countries: where it works

SEPA Direct Debit is available in all SEPA region countries, including EU member states and non-union nations. This broad international compatibility allows businesses to collect euro-dominated payments from customers (or other businesses) across all of Europe.

EU Member States and EEA Countries: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Iceland, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Norway, Poland, Portugal, Romania, Slovakia, Slovenia, Spain, Sweden, Lichtenstein.

Non-EEA Countries and Territories: Albania, Andorra, Monaco, San Marino, Switzerland, United Kingdom, Vatican City State, Montenegro.

Territories: Saint-Pierre-et-Miquelon, Guernsey, Jersey, Isle of Man.

Direct Debit payments vs. other payment methods

SEPA Direct Debit can significantly lower costs and administrative commitment compared to cards, wallets, and traditional bank transfers. It enables a more predictable cash flow thanks to the defined terms of payment detailed in the SEPA DD mandate.

Differences | SEPA DD | Cards | Digital Wallets | Traditional Bank Transfers |

|---|---|---|---|---|

Cost for Merchants | The SEPA Direct Debit scheme offers some of the lowest costs for euro-dominated payments within the SEPA region. Merchants typically pay a small bank processing fee, avoiding card scheme charges and currency conversion costs. | Card payments come with the burden of interchange fees, along with card scheme fees and cross-border exchange costs. These can all add up quickly, especially for high-ticket or international sellers. | Digital wallets generally charge similar rates to cards for processing payments due mainly to most wallets being funded mainly by cards. Some wallets also add their own service fees, further increasing costs. | Traditional bank transfers within domestic boundaries can be low-cost, but as soon as those transfers go international, prices rise. International transfers are often subject to high fixed fees and currency conversions. |

Transaction Speed | Funds from SEPA direct debit transactions settle within one to two business days after the agree upon collection date. This creates a consistent billing schedule aligned with recurring payment needs. | Card payments can offer instant authorisation, but settlement can take between one to three business days depending on the acquirer and processing network. | Digital wallets can deliver funds to merchants quickly, sometimes within hours, but typically follow a one to two day settlement. Delays can happen should outages occur on the provider’s end. | Domestic bank transfers can arrive in your business account on the same day. However, cross-border transfers can take several days or even weeks to process. |

Cash Flow Predictability | SEPA Direct Debit is initiated by the merchant, not the customer. This enables predictable and consistent oversight of cash flow. Such visibility makes it ideal for businesses offering subscription-based services, with payment dates set in advance. | Card payments depend entirely on customers to initiate the payment. In some cases, merchants may be able to keep card information on file, but this can introduce new operational complexities due to the strict nature of storing card data. | Digital wallets face a similar degree of unpredictability as cards. Additional hurdles can arise if the customer’s wallet has an insufficient balance or if their connected funding source fails to authorise or fund a transaction. | Traditional bank transfers are always initiated by the payee, meaning businesses must wait on the customer to remember upcoming payments. This can result in significant cash flow variability. |

Fraud Risk | SEPA DD has low fraud risk thanks to its mandate-based authorisation process and required bank-level verification. Customers are protected by clearly defined refund rights under the Core scheme, while merchants experience reduced exposure to unauthorised transactions. | Card payments are a frequent target for fraudsters, especially in card-not-present transactions that occur online. Tools like 3D Secure do exist to add extra layers of protection to card transactions, but they can also increase checkout friction and drop-off rates. | Many digital wallets use tokenisation technology and multi-factor authentication to keep payments secure. However, they are still susceptible to account takeovers and phishing attacks. Risk can increase drastically depending on the customer’s cybersecurity awareness. | Bank transfers are exceedingly difficult to reverse, making them secure once they finish processing. If the payment details are compromised before initiation, or if an unauthorised transaction is not caught during processing, fraud can occur with few recourses. |

Payment Timeliness | SEPA Direct Debit allows the creditor to set exact collection dates, protecting them from missed or forgotten payments. With SEPA DD, merchants no longer have to chase overdue invoices or suffer from unpaid bills. | The timeliness of card payments depends on the customer’s immediate action or stored credentials. Delays frequently occur due to incorrect or expired card information. | Like cards, digital wallets depend on customer approvals to process transactions, subjecting the payments to potential forgetfulness. | Traditional bank transfers are the least reliable for timeliness, as they fully require the payee to remember to initiate the transaction. |

Refund rules & chargebacks in SEPA Direct Debit

Refund rules and chargeback capabilities depend on whether you’re dealing with the Core or B2B SEPA Direct Debit scheme.

For authorised SDD Core transactions, customers have up to 8 weeks to request a refund. For SDD Core unauthorised transactions, customers have up to 13 months to claim a full refund.

However, B2B payments are subject to stricter rules and rarely qualify for refunds. The more stringent nature of these direct debits comes down to the typically much larger sums being transferred between business entities compared to consumer payments.

Benefits for businesses using SEPA Direct Debit

- Faster, automated payments charged directly from the payee’s bank account.

- Less administration work and elimination of manual fund transfers.

- Businesses need just one bank account to manage payments across the entire SEPA region, rather than maintaining a separate bank account in each country of operation.

- Fewer errors and fraud attempts thanks to the specific details included in mandates.

- Immediate confirmation of transactions.

- Improved cash flow visibility, especially in recurring payments.

- Regulated chargeback and refund rules.

How to set up SEPA Direct Debit for your business

Setting up SEPA Direct Debit as a payment method for your business requires you to follow several necessary steps. The process can vary depending on whether or not you choose to work with a third-party service provider who can help simplify key parts of the setup workflow:

- Confirm your eligibility as a business. You must be located within the SEPA region and hold a bank account capable of sending and receiving euro-dominated payments.

- Obtain a Creditor Identifier, or work with a third party. A Creditor Identifier is a unique reference issued by your bank that identifies your business as an authorised party for collecting funds under the SEPA Direct Debit scheme. If you choose to work with a third-party for completing and managing mandates, you may be able to skip this step. Full requirements for Creditor Identifiers are provided by the European Payments Council.

- Establish your SEPA bank account. If you haven’t already, open a business bank account within the SEPA region to begin accepting all SEPA-related payments.

- Determine your mandate management strategy. You can choose to manage mandates entirely in-house, or you can work with a third-party provider to streamline and simplify this process. In-house management requires you to store copies of each mandate signed securely for as long as required under SEPA rules and local regulations.

- Prepare your pre-notifications. Mandates require you to send advance notice of an upcoming collection, usually 14 days beforehand. Within a pre-notification, make sure to include specific details like the payment amount and collection date.

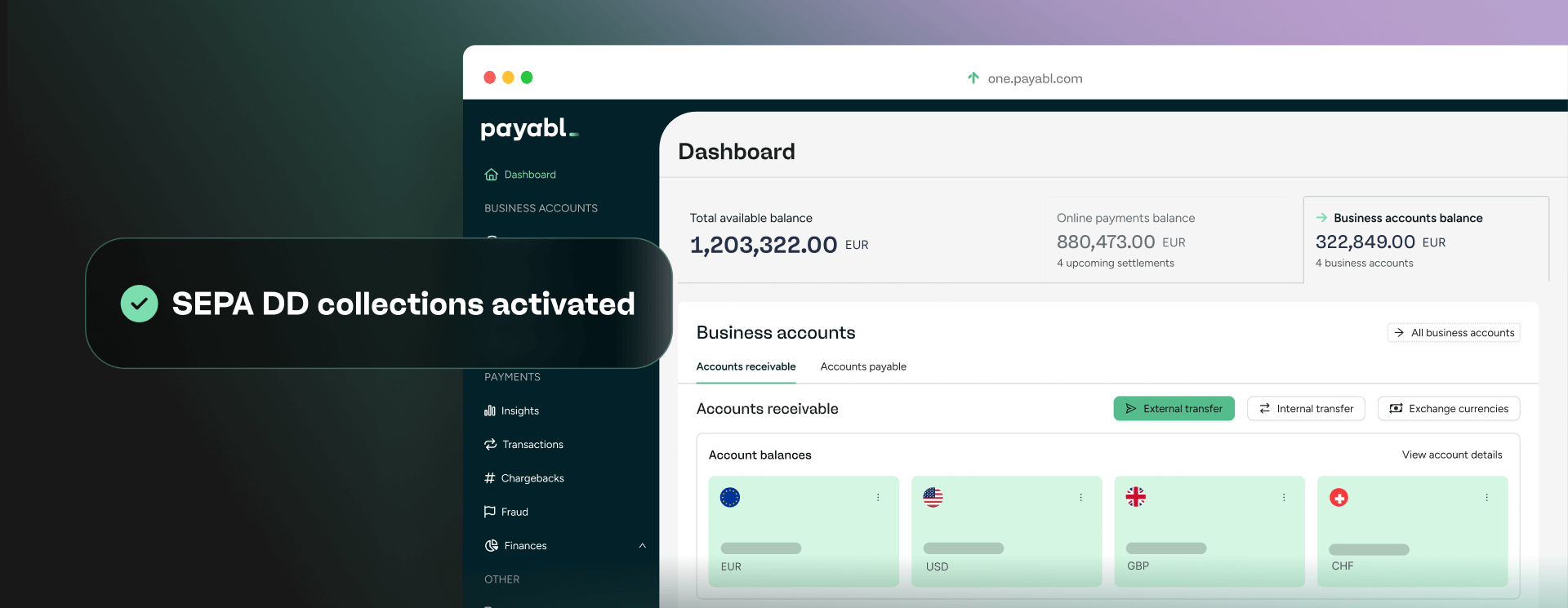

At payabl., we offer SEPA Direct Debit Core payments to help you streamline your transactions across the SEPA region. With a payabl. business account, you gain access to not just SEPA Direct Debit, but the SEPA Instant and SWIFT payment rails as well. Contact our team today to get started.

FAQs: Refund rules & chargebacks in SEPA direct debit

Can SEPA Direct Debit be used for one-off payments?

Yes! While SEPA Direct Debits are commonly used for recurring payments, they can also handle single authorised transactions. Whether a transaction is a one-off or recurring payment must be clearly defined within the mandate.

How long do SEPA Direct Debits take to transfer funds?

A SEPA Direct Debit typically takes one to two business days to finish processing after the schedule collection date. If you are in need of instant payments, you can look into adding SEPA Instant Credit Transfers to your payments strategy.

Is SEPA Direct Debit available outside of the European Union?

Yes, SEPA Direct Debit is available as a payment method anywhere within the SEPA zone, including non-EEA countries and territories.

Conclusion

Adding SEPA Direct Debit as a payment method helps you to make your one-time and recurring payments more streamlined and transparent. The SEPA Direct Debit scheme gives you more control over when funds are collected and makes it easier to avoid delays and disputes.

Ready to setup SEPA Direct Debit?