Travel packages purchased by Europeans constitute a multibillion-euro industry.

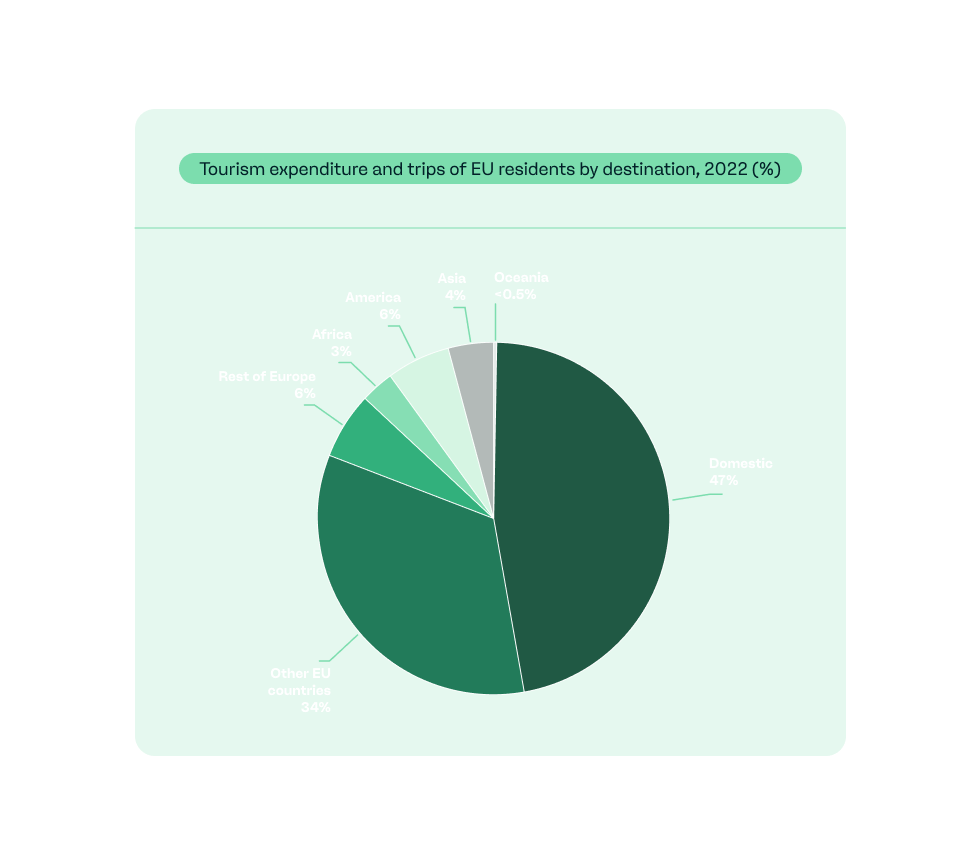

According to the latest tourism statistics from Eurostat, EU residents spent a whopping €474 billion on travel and tourism in 2022. 88% of their tourism expenditure went into trips within Europe, indicating a strong trend of Europeans choosing to travel within their continent.

The European Travel Commission predicts that the numbers for tourism spend in the European region in 2024 might break some major records!

In this article, we'll explain why European online travel agencies are in dire need of payment processing and alternative payment services to keep up with the huge demand from European travellers.

Why Online Travel Agencies (OTAs) need reliable payment processing solutions

While the statistics we talked about are indicative of the magnitude of the market, the full image can be seen by discovering how big the travel segment is in the context of European eCommerce.

Airlines and hotels seem to be two of the biggest segments in eCommerce throughout the entire European Union! This means that consumers purchase travel services online, above all other products and/or services.

The growing needs in payment processing for travel industry members need to be adequately met with the right solutions.

What is a travel merchant account, and who is it for?

All travel merchants processing payments online need a travel merchant account offered by a payment services provider (PSP) or a merchant acquirer so they can accept payments made online and receive them in one secure place.

Travel businesses in eCommerce often face some difficulty or other when trying to secure merchant agreements with payment processors. This is a result of certain segments within the travel industry being classified as high-risk by many card schemes.

One reason behind this classification is that the greatest difficulties and risks lie with airlines and cruise lines. This is because the services are often purchased a long time prior to delivery of the actual product and/or service. This naturally increases the chance of chargebacks.

As a matter of fact, chargebacks and fraudulent transactions from airline and cruise line purchases are more common than in many other industries. There is a negative impact on both the travel agency and the payment services provider due to the increased fraud risk.

payabl.: Your payment processing partner

Ecommerce for travel involves a certain level of risk when it comes to payments. As mentioned above, chargebacks are a frequent occurrence when it comes to the travel industry, along with other fraudulent practices.

payabl. possesses the technological infrastructure and knowledge to provide a secure environment for the processing of payments, thus ensuring that merchant services for online travel agencies meet the highest of standards.

The following services are important features that should complement merchant accounts for online travel agencies.

1. Risk management

Our merchant services for travel agencies include risk management and fraud prevention tools for transactions through different payment methods. These tools help identify any possible fraud in online travel payments. Pre-authorization is also supported, lowering the risk of chargebacks, a technique typically used by fraudsters and quite common in travel eCommerce.

2. Checkout pages

We offer fully customizable checkout pages with flexible interfaces in combination with a selection of languages to suit individual travel businesses. This enables seamless, direct integration in multiple programming languages to ensure user-friendly payment systems.

3. Payment gateway services

3.1 Technology and data security

Our self-developed technology ensures that all security protocols and standards, including PCI and GDPR, are fulfilled via a TLS 1.2 SSL connection from our servers. Customer data is anonymized and encrypted via payment tokenization to help prevent data theft or loss.

3.2 PCI compliance

All eCommerce Travel merchants should have an understanding of what PCI compliance is and the importance of choosing a processor who is compliant.

PCI DSS, which stands for Payment Card Industry Data Security Standard, is a set of security standards that must be followed by companies that accept, process, store, or transmit payment data for any payment method.

Any online travel agency or eCommerce travel merchant can gain significant advantages by choosing a PCI compliant processor, such as increased levels of trust between the customers and the business, which can result in more returning customers.

3.3 Reporting

payabl.'s system offers 24/7 access to reliable data for all transactions that go through. Travel eCommerce merchants can monitor transaction processing, have access to financial reporting, reconcile settlements generated by day, and check outstanding settlement amounts and reserves. Reporting tools include both risk and financial management systems for the online travel agency to analyze the performance of their business.

Alternative payment methods for the travel industry

Although a large fraction of people use Visa and Mastercard to purchase services offered by travel merchants, many other methods have been rapidly gaining popularity recently. With a travel merchant account from payabl., you can be assured that a wide range of alternative payment options are available to prospective clients in different regions.

Offering alternative or more localized payment methods attracts customers because they get the flexibility to pay via a method they are most familiar with or, perhaps, like best. This is particularly helpful for online travel agents looking to expand globally.

Some of these alternative payment methods include

- Bank transfer services (e.g., Sofort, iDeal, Trustpay, Trustly, SafetyPay)

- eWallets aka digital wallets (e.g., Skrill, Alipay, China UnionPay, Paysera, Qiwi, Zimpler)

- Prepaid vouchers (e.g., Paysafecard)

Partner with payabl. for a travel merchant account

Being a payment gateway, payment processor, and acquirer, among other things, payabl. supports all kinds of travel businesses with easy-to-setup and reliable travel merchant accounts to handle all their payment processing needs.

Accepting and processing eCommerce travel payments online with minimal risk means you get to operate under minimal stress, focusing on what you do best: ensure the growth of your online travel merchant services. You can rely on payabl. to carry the burden of risk and gain peace of mind.

A travel merchant can initiate their account procedure by filling in their details. A representative will reach out and get the ball rolling. Alternatively, you can drop us a message to gather more details about our travel agent merchant account services.