Payment speed and security are two of the most important considerations for every transaction, whether online or offline. Merchants are obliged to offer their customers advanced security measures that will protect their data during the payment process.

Card tokenization is one of the many solutions that are widely used by merchants to protect their customers from credit card fraud and enhance their payment experience. Tokenized transactions are a vital component in ensuring customer satisfaction and security during the payment process.

This article will expand on payment tokenization and the role of tokenized transactions in the payment journey.

What is payment tokenization?

Payment tokenization involves confidential information, like personal and credit card data, being replaced with a randomly generated number, known as a token, to protect cardholder data from being exposed and hacked by criminals.

Storage of sensitive data may only be done in PCI certified environments, such as via payabl. Merchants who are not PCI Level I certified do not have access to the credit card details of a customer as they do not store any sensitive information in their payment systems but view transactions as randomly generated tokens only.

Without the need to store card data, the PCI compliance scope of merchants is greatly reduced and the responsibility of tokenizing their transactions is assumed by the payment gateways they utilize. Tokens are safely held in the payment processor's token vault, which is a server where encrypted payment tokens and their respective sensitive data are securely stored.

Tokenization can be applied to point-of-sale, e-commerce, and mobile or digital wallet transactions. It is a necessary step to eliminate cardholder data exposure and protect your customers without any steps being taken from their end.

For instance, in payment tokenization, customers are not asked to verify their details, unlike what happens in the case of 3D Secure transactions. Instead, the process happens automatically, thanks to the merchant's tokenization service provider.

For merchants in industries where the speed of payment transactions without compromising security is vital, such as the travel industry, the importance of partnering with a payment provider offering tokenization solutions is of the essence. As a European-regulated payment provider, payabl. offers payment tokenization solutions to merchants looking to mitigate risk and improve payment security.

Tokenization vs encryption

Both tokenization and encryption can be a crucial part of the payment processing system. They are sometimes used interchangeably in the context of tokenization. However, there is a difference between the two.

Tokenization makes use of randomly generated alphanumeric strings to replace original payment data and hide it for higher security. Storing tokens in an isolated yet central location, it is largely based on access control.

Encryption, on the other hand, if applied to payment data, would make use of a cipher to encode plain data as ciphertext. It is more calculated and strategic than tokenization in that it is based on special algorithms.

Both processes are reversible, but payment tokens are useless outside of a token vault, while decryption can be done by anyone who has the key. The original data can thus be obtained in both cases by using the suitable method.

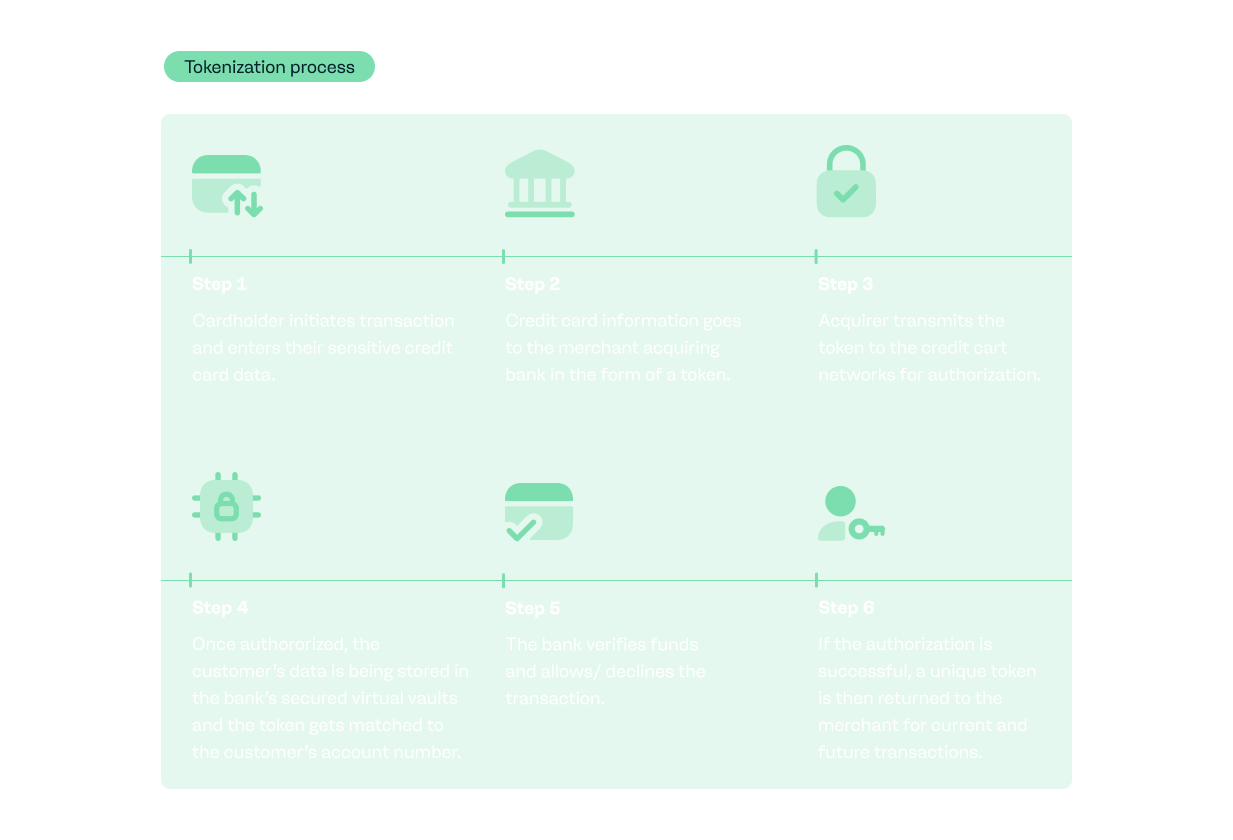

The payment tokenization process

So, what does the payment tokenization process entail?

When a debit or credit card is used by a customer to perform a purchase, sensitive payment data such as the card's 16-digit personal account number (PAN), the expiration date, and the security code are all substituted with a unique string of numbers called a payment token.

The encrypted data token is then transmitted to the payment processor who is responsible for de-tokenization and authorization of the payment.

It's important to clarify that a token is only ‘readable’ by the payment processor and not the customer or the seller. If customers use the same card to purchase services or goods from various merchants, a different token will be generated for each merchant service.

The benefits of payment tokenization

Tokenized transactions are beneficial for every merchant who accepts online or mobile payments as it provides several benefits. Here are the top five advantages of tokenizing payments for online merchants and their customers.

1. Improved user experience and conversions

The most dreaded part of many online payments for the user is having to enter payment details each time they shop.

Payment tokenization can contribute greatly towards a smoother customer experience when making online purchases. When repeat customers are given the option to safely store their payment and personal details for future transactions, they are more likely to enjoy the convenience of one-click payments while enhancing their loyalty towards your online store.

2. Increased customer loyalty and trust

Customers are more concerned than ever about their security during online shopping.

If your customers know that their personal and payment information is safe when they shop from your store, they will trust your company and choose you over your competitors for future purchases, too.

3. Lower risk of data breaches

The transition of sensitive data to encrypted payment tokens minimizes the possibility of a data breach and its potentially disastrous consequences.

Even if criminals attempt to steal or copy credit or debit card data from a merchant's server, they will only manage to obtain tokenized information which would hold no real value for them.

4. Internal protection of sensitive data

Stealing of customer payment data does not only happen by hackers. Criminal attempts can also come from people within your organization. Therefore, cardholder information should securely be stored in the form of a token to ensure that it is not accessible by your employees, suppliers, vendors, or any other stakeholders that could possibly gain access to it at any point via any means.

5. Lower PCI scope

According to the PCI Security Standards Council’s official guidelines, using a tokenization solution doesn’t completely absolve a merchant from maintaining PCI DSS-compliant status on their end. However, it can help make it easier for the merchant to comply with PCI DSS requirements by reducing the number of system components that need to be compliant.

The use of payment tokenization in recurring payments

Companies selling subscription-based services or products that are billed recurringly can implement tokenization to ‘save’ their customers’ sensitive payment data securely in the form of tokens.

By doing so, at the end of each payment cycle, the merchant can use the token associated with each customer's credit card details, eliminating the risk of a data breach or other security risks that the customer might get exposed to in case they have to re-enter their payment information on a regular basis.

Tokens are ideal for recurring payments as they cannot be duplicated or decoded by anyone apart from a payment processor. So, if you are looking for a smooth payment process for your repeat customers, tokenization is definitely the way to go.

Why choose payabl.'s transaction tokenization services

Our experience in the payments industry, along with our expertise in payment processing and risk management solutions, renders us a trusted partner in ensuring data security during the payment process on your online store.

payabl. offers debit and credit card tokenization solutions backed by its PCI Level I compliant proprietary gateway. Our merchants entrust the data security of their payment transactions to our technological solutions, which provide them with secure tokens each time a payment occurs.

Our tokenization transaction solutions enable users to make purchases on our merchants' websites by entering their payment information once, without the need to put their details every time they make a transaction. This information is then securely stored and transmitted, whenever it is needed to complete a purchase, in the form of a token.

Find out how payabl. can assist you in securing your payment process against potential data breaches. Contact us!