The Single Euro Payments Area initiative has transformed transactions in Europe, improving payment efficiency and cost-effectiveness compared to other payment methods, like cards or wallets. In 2022 alone, more than 21,635 million SEPA Direct Debits were processed in the region.

For customers to use SEPA Direct Debit as their payment method, they must first sign a mandate.

What is a SEPA mandate?

A SEPA mandate is a legal agreement between a merchant and a customer that defines clear terms of payment and allows collection of funds directly from the customer’s bank account.

Operating under the SEPA Direct Debit Scheme allows participating countries across the European Union and non-EEA countries to standardise payments. Merchants can consistently complete payment authorisation and give payees greater confidence in how their funds are handled.

The mandate confirms the customer’s agreement to pay the merchant and enables the merchant to collect payments without repeated approvals for each transaction.

SEPA mandates are a necessary component of all SEPA Direct Debits (SDD), though they have different requirements depending on whether it’s SDD Core or SDD B2B. SDD Core is designed for general transactions between customers and businesses, while SDD B2B is for businesses only.

Both versions help streamline payment transactions throughout the European Union and broader SEPA region. Businesses can accept funds in euros from bank accounts in any SEPA-participating country without having to maintain separate bank accounts in each nation.

While both require the same information, the SDD Core mandate is much more straightforward, while the SDD B2B mandate is more stringent. Both incorporate comprehensive security measures to protect all participating businesses and customers from unauthorised transactions. Only authorised parties can initiate debits and payees retain the right to pay only under agree terms.

How SEPA direct debit works

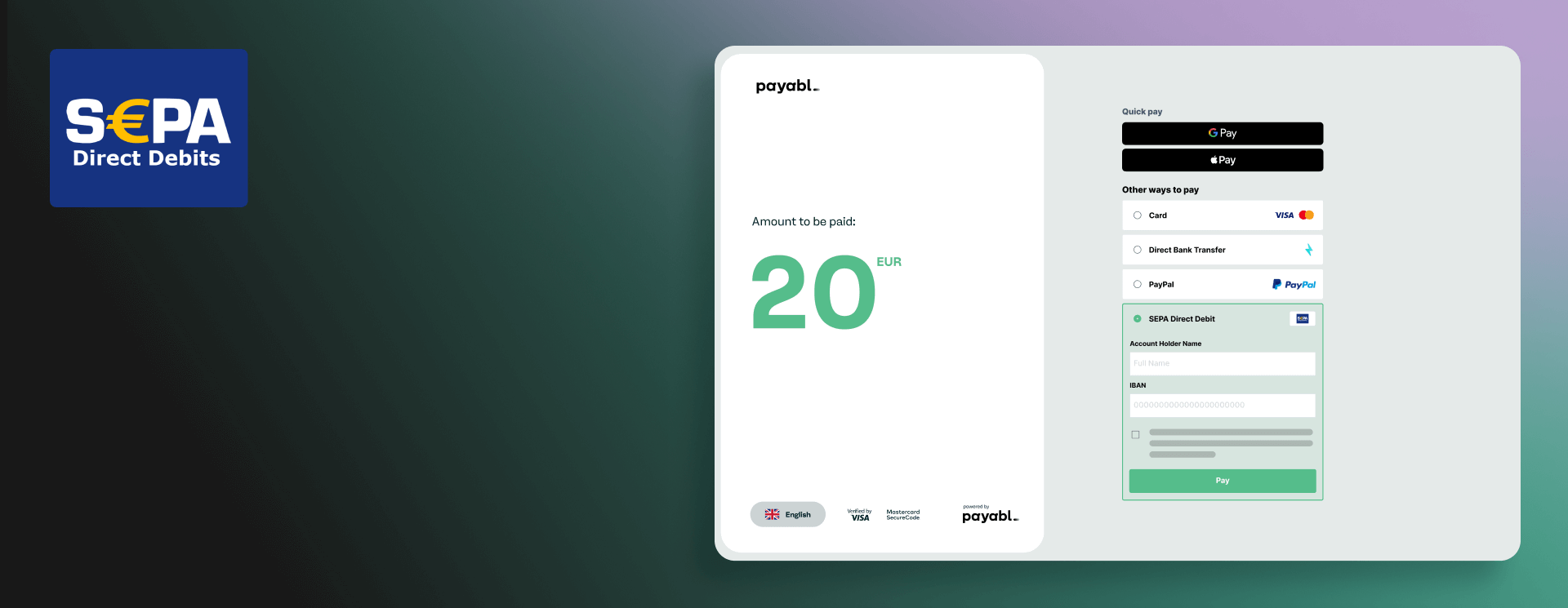

Once a business sets up SEPA Direct Debit Core, the process of how it works is simple:

- The first time a customer chooses SEPA Direct Debit as their payment method, they will be redirected to an electronic mandate form (paper forms are also available for in-person payments).

- The customer enters all of the required information and signs it.

- After this initial signing, the business can charge the customer’s bank account directly according to the terms of the agreement without requiring any additional action from the customer, including for recurring payments.

Similar steps are followed for SEPA Direct Debit B2B.

However, the SDD B2B version requires the creditor to perform additional mandate verification steps that are not required for SDD Core. This process discrepancy is primarily due to the much larger payment amounts often seen in B2B transactions.

A clearly defined workflow results in fewer disputes and smoother customer experiences for both Core and B2B use cases. Businesses gain the advantage of predictable settlement times, and customers know exactly when to expect collections from their accounts. Such clarity also reduces operational impacts on accounting teams by making it possible to schedule reconciliation processes according to the SEPA payment timeline.

Components of a SEPA mandate

When creating a SEPA mandate for your business, each element plays a critical role in helping your business meet regulatory and operational standards. Any missing information can delay your payments and potentially result in collection failures and disputes. Such issues can be avoided by following the guidelines provided by the European Payments Council.

A SEPA mandate has many mandatory attributes that must be included for it to be valid, including:

- A unique mandate reference

- The name, address, postal code/city, and country of residence of the payee (also called the debtor)

- Important note: The payee’s address, postal code, and city are only required when their bank is located in a non-EEA SEPA country or territory.

- The payee’s International Bank Account Number (IBAN)

- The payee’s Bank Identifier Code (BIC)

- The company name, address, postal code/city, and country of the creditor (your business)

- The type of payment (can be either “one-off” or “recurring”)

- A signature of the place and time

- The signature of the debtor

If you are creating a SEPA mandate for use at your business, make sure to follow all of the appearance guidelines detailed by the European Payments Council.

How to set up a SEPA direct debit mandate

The beauty of the SEPA payment system is that it vastly minimises the technical effort required of businesses. To set up SEPA Direct Debit mandates, you can choose one of two options:

- Set up direct access: You can perform SEPA Direct Debit collection entirely in-house through the direct access method. To do so, you will need to set up a Creditor Identifier with your bank. You can then create your mandate form, or purchase a pre-made or custom form, which your business will then be responsible for managing.

- Third-party providers: If you’d prefer to minimise administrative overhead of SEPA Direct Debit, you can opt for a payment service provider or direct debit specialist instead. Doing so makes it easier not only to manage the payment method itself but also to simplify mandate management and compliance.

Benefits of using SEPA mandates

Cost Benefits | Operational Benefits | Customer Experience Benefits |

Lower transaction fees | Automated payment collection | Fewer payment reminders |

Reduced processing costs | Lower risk of fraud and chargebacks | Secure mandate process with clear payment agreements |

Fewer failed payments | Simple integration with your checkout system | Support for payments across all SEPA countries and territories |

Zero currency conversion fees | Recurring payment support | Seamless transactions with automatic fund withdrawals |

SEPA compliance and legal considerations

SEPA’s legal framework is based primarily on four distinct regulations:

- Cross-Border Payments Regulation

- Payment Services Directive (PSD/PSD2)

- SEPA Migration End-Date Regulation

- Interchange Fee Regulation

Along with completing the necessary mandates for SEPA Direct Debit, your business must also ensure compliance with each of these regulations and their respective requirements.

Frequently Asked Questions

Who can use SEPA Direct Debit mandates?

Any individual or business residing within one of the countries or territories of the SEPA region.

What are the SEPA Direct Debit refund rules?

For SDD Core, customers can request a refund within 8 weeks of the payment. In cases of an unauthorised payment, customers have up to 13 months to dispute the charge.

Where can your BIC and IBAN be found?

The exact location of a BIC and IBAN can vary depending on the bank, but can generally be found on a Statement of Account.

Conclusion

At payabl., we offer SEPA Direct Debit solutions to help you automate your payments and simplify the mandate process. With a payabl. business account, you can save time, reduce admin, and minimise fees.

Contact our team today to get started.