Today, more and more businesses are embracing the eCommerce revolution. Most consumers are actively using e-payments for most of their daily purchases. McKinsey has been conducting a survey on the popularity of various payment methods for the last eight years. In 2023, for the first time ever, 90% of the 1800 participants revealed that they had used some sort of digital payment method at least once in the span of a year.

Given how electronic payments have become so popular, with increasingly innovative digital channels being introduced rapidly, businesses need to understand what e-payment systems are and how they work so they can utilize them to their maximum potential.

What is an electronic payment system?

An electronic payment system or online payment system allows customers to pay for products or services via electronic means. It’s also sometimes called a digital payment system. These payment methods allow customers to purchase goods from their favourite online stores worldwide. To take advantage of these online payment options, merchants seek professional services – payment providers like payabl. – who are experts in handling them.

How do electronic payment systems work?

Before you partner with a payment provider like payabl., it is important to learn how an electronic payment system works. While the technology involved is quite complex, the process is quite easy to understand. First, let’s talk about all the key players involved in e-payment processes.

Participants in the e-payment process

- The customer – The purchaser of the product or service offered online – they are also known as the cardholder.

- The merchant – This is the owner or entity that runs the web platform which sells the product or service to consumers. Merchants don’t just have to sell their products or services. They are also responsible for the monitoring and control of their online store’s inventory, storage, delivery operations, and payment process, as well as the financial management of the business and the promotion of the products or services they sell.

- The issuer – Often known as the issuing bank, this is the customer’s bank and the financial institution that provides the customer with their credit card.

- The acquirer – With a role that is similar to the issuer’s, the acquirer is the financial institution that is aligned with the merchant and is responsible for the creation and maintenance of the merchant’s bank account. Acquirers are responsible for payment processing when credit and debit cards are used.

- The payment processor – This is the entity whose main operational function is to connect the merchant to their acquirer. The payment processor decides the route which the transaction should take, providing the technology needed to accept and process online payments, which include connections to a payment gateway and risk management solutions.

An understanding of what an electronic payment system is and which parties are involved is essential for optimizing the operations of eCommerce merchants. Online payment systems work in a more complicated way than the customer perceives, largely because despite the several steps involved in electronic payments, the entire process is executed in mere seconds.

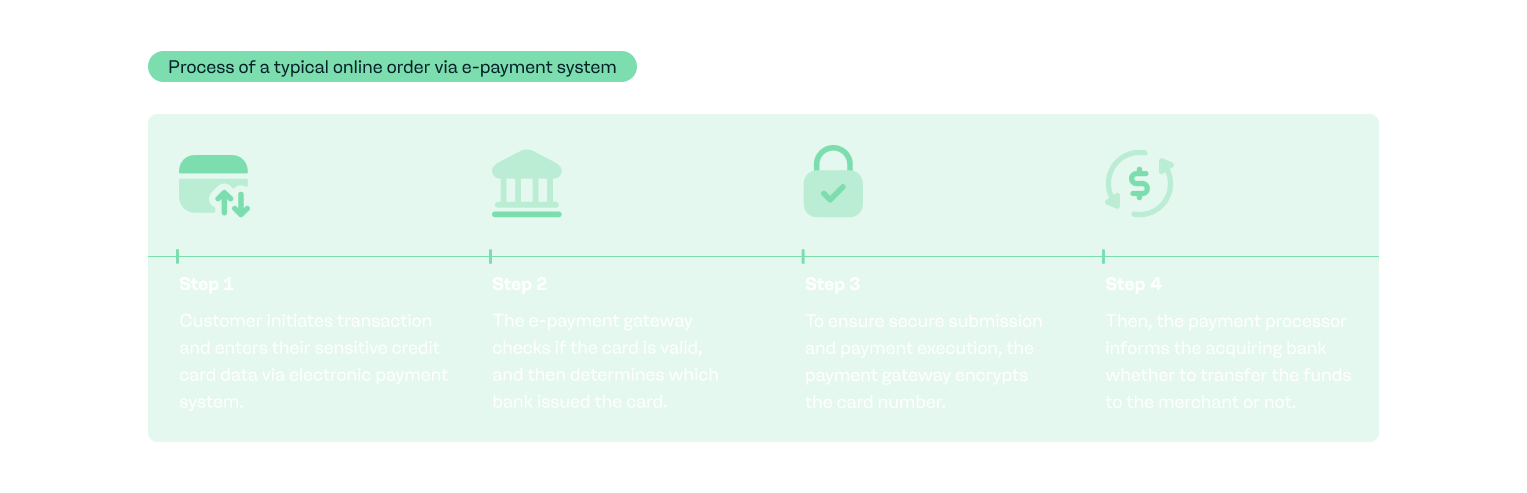

The process: How a typical online order works with an e-payment system

The online customer initially browses a website, selects the items they would like to purchase, and adds those products to their shopping cart so they can proceed with their purchase.

Once they proceed to the checkout, the customer is asked to fill out the online payment form with their credit card details via an electronic payment system.

Once the cardholder submits their payment information and clicks the button, which may be titled ‘Purchase’, ‘Place order’ or similar, the e-payment gateway checks if the card is valid, in some cases using 3DS tools to authenticate the legitimacy of the cardholder, and then determines which bank issued the card.

To ensure that this information is submitted securely for the payment to be executed, the encryption of the card number is performed by the payment gateway. Then, the payment processor informs the acquiring bank whether to transfer the funds to the merchant or not.

4 popular electronic payment methods

Electronic payments are usually made via credit or debit card, but a number of alternative payment methods can also be used to pay online as eCommerce is increasingly becoming more cross-border than domestic.

Let’s talk about four of the most popular e-payment methods widely used all over the world.

1. Debit cards and credit cards

Visa, Mastercard, and American Express are the most well-known brands for debit or credit card payments. The three brands provide advanced security features, such as 3D Secure and Identity Check, to protect their cardholders from online payment fraud.

There are, of course, many more card networks worldwide, including Discover, Maestro, UnionPay (China), JCB (Japan), and Carte Bleue (France, now discontinued).

2. E-wallets

Also known as a digital wallet, an e-wallet is a mobile app which stores a user's credit card details and personal information and can be used for online and in-store purchases. By using an electronic wallet, there is no need for a customer to reach for a physical card in order to complete a purchase.

According to recent numbers reported by Forbes, 53% of buyers in the US prefer digital wallets over other traditional forms of payment, with Generation Z shoppers being twice as likely to choose that payment option than the older population.

3. Bank-to-bank transfers

Bank-to-bank transfers are real-time electronic funds transfer transactions from customers' bank accounts to the merchant's bank account. Contrary to wire transfers, which take longer to clear, bank-to-bank transfers enable the merchant to receive payments online and instantly.

This payment option is also very convenient for customers because they don’t need to register a new online account to complete their purchase. Instead, the option to pay with a particular bank-to-bank transfer system, such as Sofort or Giropay, is available on the secure payment page of the online store. Here, the consumer should be able to log in using their online banking details in order to confirm the transfer.

4. Prepaid vouchers

A prepaid voucher is an ideal option for customers who wish to shop online and do not have a bank account. A customer effectively preloads funds into a voucher, most commonly by purchasing such a voucher with cash, which does not require the involvement of a bank. Prepaid vouchers usually come with a fixed amount and do not require any personal details of the shopper in order to be used at the point of sale. They are particularly popular in developing countries, where banking systems underserve the population.

Which e-payment options should you offer?

Merchants should aim to offer a variety of payment methods to their customers so that they can reach a broader audience. This is precisely why merchants opt to utilize the services offered by payabl. and other payment providers. Doing so provides their target markets with an electronic payment method that they’re more accustomed to using.

For those looking to partner with an electronic payment provider, make sure you choose one that offers a comprehensive list of alternative payment solutions serving the different regions of the world.

As the payment industry evolves and customers have less and less free time, it will be no surprise that more electronic payment methods will be developed in the near future to serve the increasing and more advanced demands of online consumers, which naturally makes payabl. a valuable ally for online merchants.

Types of electronic payment transactions

Electronic payments can be broadly categorized into two types: one-time payments and recurring payments.

One-time payments

The most common type of payment, largely related to online transactions, these are one-off payments. They are a typical type of transaction for e-tail stores and involve a cardholder manually entering their credit card and personal information in a one-off event on an eCommerce checkout page for placing a specific order.

Recurring payments

When a customer pays for a product or service repeatedly and on a regular basis, that’s called a recurring payment. The customer opts in for recurring billing and is charged on specific days at specific time intervals on an ongoing basis until they cancel their subscription or the service itself is discontinued. Charges are deducted automatically, without the customer having to enter the order or their card details to repeat the process. Examples of instances where this type of e-payment is common include media subscriptions, utility bill payments, online course subscriptions, online dating, online gaming, and adult entertainment.

Depending on the nature of the business, merchants can also accept both modes of payment with the help of their payment provider. For example, a SaaS company might offer both types of online payment systems. Some of their clients might prefer to pay once for a whole year of service or just buy a lifetime license, while other clients might want to be charged monthly.

The advantages and disadvantages of e-payment services

E-payment services are a must-have for every online business. Merchants who accept electronic payments can enjoy various advantages and, at the same time, significantly improve their customers' experience.

The benefits of e-payments for customers and vendors

Here are some ways merchants and their customers can benefit from electronic payments.

Convenience

Customers can buy and pay for products online 24 hours a day, 7 days a week no matter where they are located – all it takes is a device with an internet connection. Both types of electronic payment, whether a one-time payment or a recurring payment, are way more convenient compared to a shopping visit to a physical store.

Speed

An e-payment is done immediately, and there is no need to wait for approval. The process of paying online becomes even faster when using an e-wallet which has the user's payment data already stored. It's important that an eCommerce website is easy to navigate and has a quick loading time, as consumers have limited time nowadays and they are seeking increasingly easier and more efficient ways to buy products and services of their choice.

Increased sales and profits

Online payments can help merchants globalize their business and attract customers from around the world. Reaching more people will result in a boost in sales, providing the business with more economies of scale. When operations are optimized, it is likely that profits for the business will also increase.

Reduced transaction costs and payment processing times

In electronic commerce, where online payments are being used, funds are transferred digitally between the buyer and seller, eliminating transaction fees and time that are typically characteristic of point-of-sale or cash transactions. For instance, cash payments would require customers to take one or more trips to financial institutions, using up their time. Electronic payments, on the other hand, are accessible right from the comfort of their homes, with a simple click taking a few seconds at most.

Concerns surrounding e-payments

While there are many valuable benefits that electronic payment systems provide, there are a few negatives to consider, too.

Security concerns

The fraud risk in eCommerce transactions is one of the main concerns of online merchants. Partnering with a regulated payment service provider that offers a secure payment gateway is the first and most important step for merchants who want to accept online payments.

A payment gateway which is equipped with the latest security features will protect the business from fraudulent transactions. But if you make the wrong choice, sensitive customer data could fall into the wrong hands, causing heavy monetary and reputational losses for your brand.

Increased costs required to protect sensitive data

Merchants must reassure their customers that the credit card details they enter on their online store are safe. One way to identify a secured website is when its URL starts with ‘https’, indicating that it is protecting sensitive data with the SSL protocol. It is symbolized by a lock on the address bar next to their URL. Merchants need to purchase SSL certificates for their domains. Although they don’t cost much, you must renew them periodically.

Another way in which merchants protect sensitive information is by complying with PCI standards. These are guidelines from the Payment Card Industry on data security for the security of sensitive data during payment processing. This can be time-consuming and complex; therefore, it is often much more advisable to utilize a payment provider.

Payment tokenization can also be utilized by merchants who do not want to store the cardholder's payment data but instead store a token ID for each purchase.

All these require significant financial investment from merchants.

By working with a PCI-compliant payment provider like payabl., you can ensure that it is the provider who is responsible for meeting PCI security standards for their payment gateway.

Make electronic payments more secure with payabl.

Electronic payments have undoubtedly changed the way businesses function. They have provided an effective new way of interacting with online consumers, offering them the chance to use e-payments for the ultimate convenience.

Now that you have a thorough understanding of the e-payment system, it is necessary to acquire the services of a trusted payment provider.

payabl. is a PCI-compliant payment provider that offers high-quality payment gateway services to merchants with one simple integration. Our services include access to 100+ global payment methods, fraud prevention, and risk management, along with live analysis and reporting. Some of these essential tech and tools include 3D Secure, Geo-Conflict, Velocity Check, BIN Lookup, and Pre-Authorization.

Benefit from our PCI DSS-compliant online payment gateway and offer your clients a seamless and secure online payment experience.

Frequently asked questions

What is an e-payment system?

An e-payment system is a mechanism used to process digital payments made via the internet.

What are some examples of online payment methods?

Online payment methods include any payment method that can be used when purchasing a product or service online. There are several online payment methods, such as credit and debit card payments, prepaid vouchers, online bank transfers, and digital wallet payments.

How do I set up e-payments on my online store?

To start offering electronic payments, you need to integrate your online store with a payment gateway. By partnering with a payment provider like payabl., you can benefit from PCI DSS-compliant e-payment gateway services and set up online payments quickly and easily.