Your business can’t afford to put customer data at risk for even a moment. Compliance penalties aside, any gaps in your payment security can cause serious damage to your reputation.

A 2024 global survey of 2,600 digital payment users across the Americas and Asia found that 63% of respondents know or have been a victim of a payment scam. Meanwhile, a Mastercard study of more than 2,300 U.S. consumers found that 65% would abandon an online retailer after a single breach.

The payment gateway you choose is an important touchpoint in the payment process.

White label payment gateways offer the combination of advanced technologies and customisable branding you need to protect your payments and provide a consistent user experience. However, white label payment gateways also come with disadvantages that are vital to consider.

White label payment gateway meaning

White label payment gateway — a payment processing solution that allows businesses to process transactions under their own branding and name without developing the solution in-house.

White label payment gateways enable businesses to offer outsourced payment processing services while maintaining their own branding for the solution. Businesses partnering with white label gateway providers can start offering payment processing services quickly without needing to build a payments infrastructure from scratch.

Today’s payments industry offers a variety of payment gateway solutions. White label options are growing in popularity, with the white label payment gateway market valued globally at more than USD 2.6 billion in 2024 and projected to reach a value of more than USD 3.7 billion by 2031.

The primary benefit of choosing a white label payment gateway over other third-party payment gateways is that you gain all the technological capabilities of an established gateway without any of the technical maintenance or management responsibilities. On the flip side, white label gateways really only offer customisation flexibility when it comes to branding. The technical components are rarely tailored to your needs and are, instead, designed as out-of-the-box solutions.

Is a white label payment gateway a payment processor?

A white label payment gateway is not always the same as a payment processor. In the payment processing industry, gateway solutions and payment processing services are typically separate, with the latter handled by more official entities like banks and other financial institutions.

| Provider type | Purpose | Integration | Compliance |

| White label gateway providers | Payment gateways provide front-end technology to securely transmit transaction data from the merchant’s system to the relevant banks. | Integrating a white label payment gateway is fairly straightforward to give you the ability to launch quickly without building a payments infrastructure from the ground up.

| The burden of compliance falls to whoever builds and maintains the payment gateway. In the case of a white-label gateway, the provider must ensure its technology meets all necessary compliance standards, such as PCI DSS. |

| Payment processors | The payment processor is responsible for the actual movement of funds between the customer’s account and the merchant’s account. | Integration with a payment processor happens through the payment gateway, placing the technical responsibility with the gateway provider to manage the integration process. | While gateway providers focus on data security when transmitting information, payment processors face even stricter compliance standards for managing the entire payment lifecycle, not just the transmission of data. |

What are third-party payment gateways and how do they compare to white label payment gateway solutions?

A third-party payment gateway is a solution that maintains the branding of the provider.

| Gateway type | Branding | Technical customisation | Customer trust | Scalability |

| White label payment gateways | White label gateways give you the greatest control over your gateway’s front-end design, ensuring customers receive a consistently branded experience. | In terms of the back-end customisation, most white label solutions offer limited flexibility. These gateways are typically designed to be out-of-the-box solutions. | A branded payment experience can help build your brand recognition among customers. However, it’s also important to consider how the lack of an established payment provider’s branding may affect trust. | In theory, white label gateways are designed to scale with your business. In practice, however, the often rigid technical infrastructure can make these solutions more difficult to scale, especially for businesses expanding across borders. |

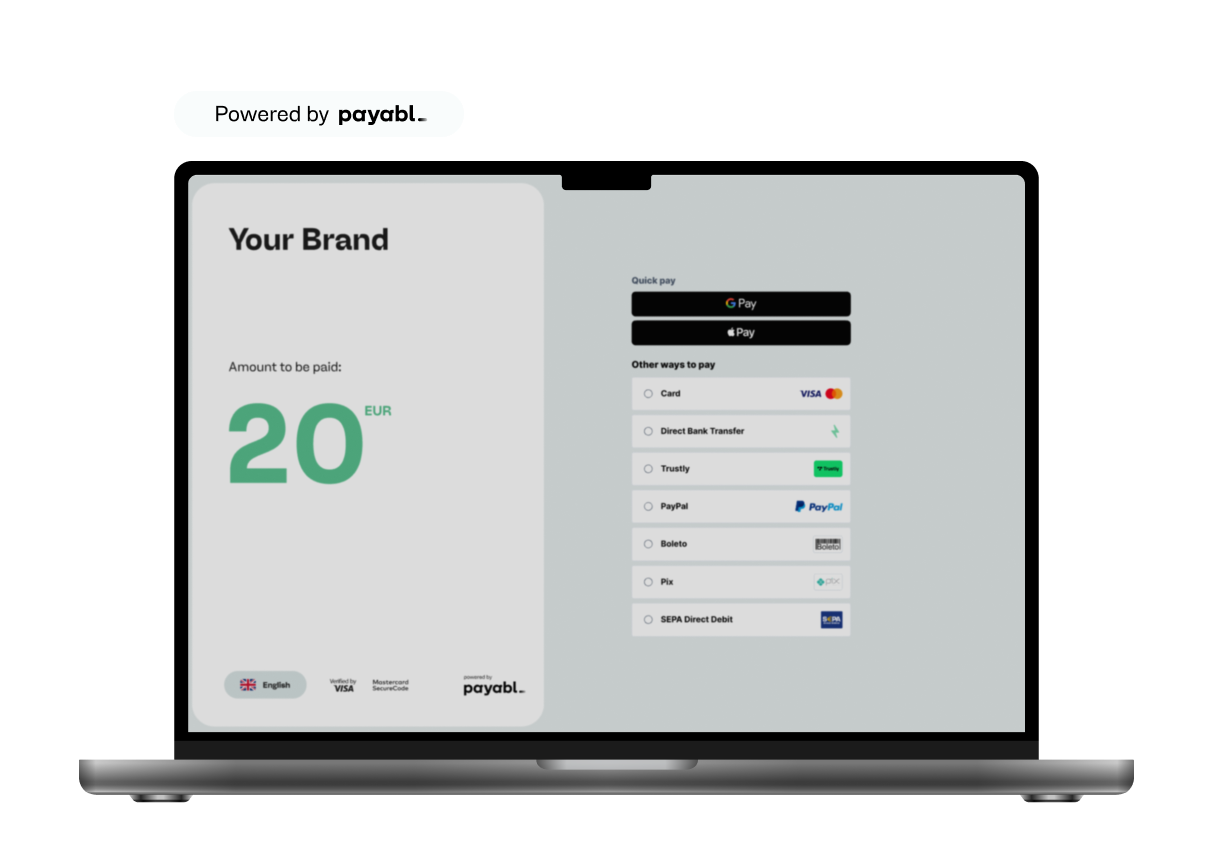

| Third-party payment gateways | While third-party gateways maintain their own branding, many offer customisation features to showcase your business branding as well. For example, payabl.’s hosted payment pages can be customised with your branding colors and logo. | Third-party payment gateways can offer a wide range of customisation options for features like payment method acceptance, currencies, languages, and other regional factors. Some providers even offer platform solutions where you can plug-and-play with different features. | Customers tend to feel more comfortable with payment brands they can recognize. Keeping your provider’s branding on your gateway and checkout page can demonstrate to customers that you use reputable technologies to protect their data. | Depending on the provider you select, third-party payment gateways operating under their own branding can be highly scalable, with different plans and advanced features to support businesses of all sizes. |

What is white label payment gateway integration like compared to third-party gateways?

Both third-party payment gateways and white label payment gateway providers typically offer APIs, SDKs, and plugins that connect seamlessly with e-commerce platforms, CRMs, or other custom systems. The main difference is that, during integration, you can customise the branding and design of a white label gateway solution.

White label payment gateway advantages & disadvantages

Speed and flexibility at checkout are non-negotiables if you want to meet customer expectations.

Customers are relying more and more on online payments — nine out of ten European and U.S. consumers have made at least one digital payment in the past year, while 21% of European consumers’ day-to-day payments are digital.

A white label payment gateway helps businesses in the payments industry simplify the payment process while maintaining control of their brand. Opting for white label solutions can be your ticket to avoiding complicated in-house builds and maintenance that can eat away at your revenue.

However, white label solutions are not without disadvantages compared to third-party payment gateways that maintain their own branding.

Consider the following benefits and drawbacks:

Benefits of white label payment gateways

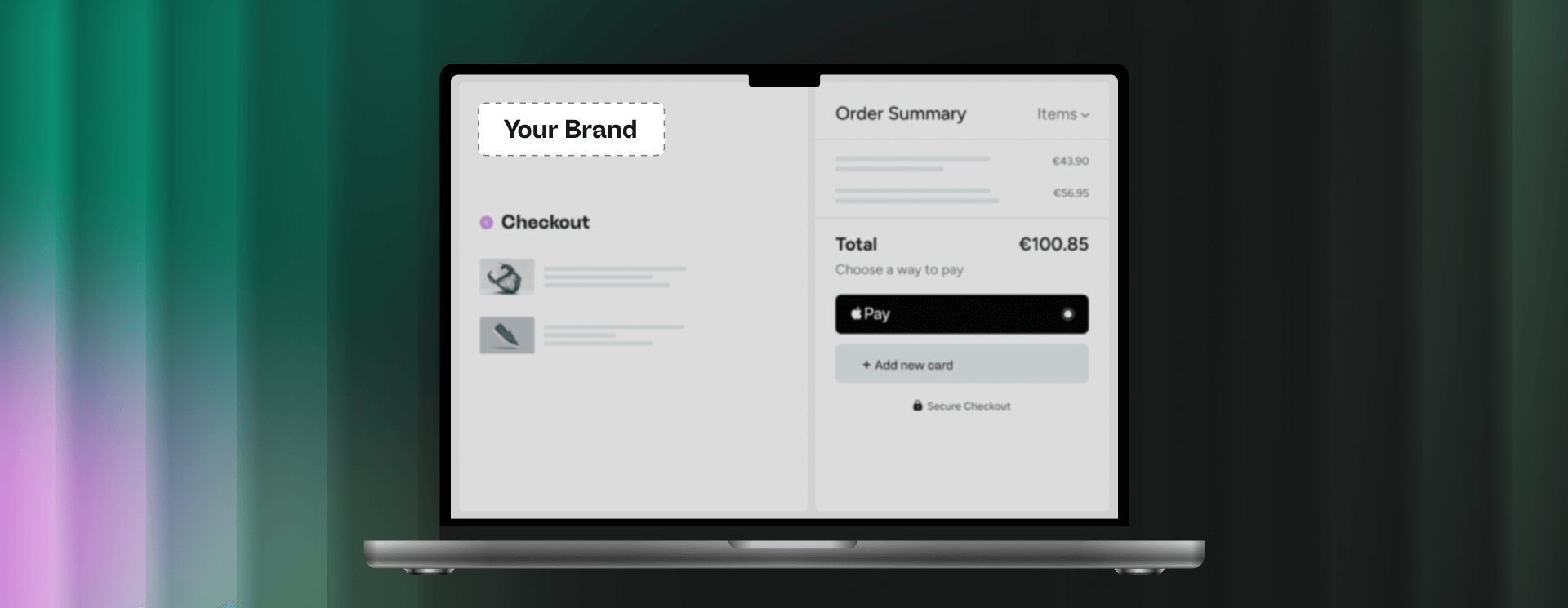

- Branded payment experiences: Branded payment experiences are one of the most compelling reasons to choose a white label payment gateway for your payments ecosystem. A white label gateway offers a customisable payment processing solution that you can tailor to your exact needs, from checkout design to messaging. You get a fully branded payment solution that keeps customers on your website or app rather than redirecting them to a third-party provider, making your brand the only thing they see throughout the payment process.

- Cost-effectiveness: Building a proprietary gateway requires a hefty upfront investment in technological resources, not to mention the maintenance and compliance costs. While it can vary by provider, the white label payment gateway price point can be significantly lower in terms of both initial investment and ongoing costs.

- Fast expansion into new markets: Expanding your business into new territories and reaching new sects of customers requires you to adapt to local regulations and payment preferences. A white label payment gateway provider that tailors its solution to specific markets makes this process far easier by offering built-in features that speed up market entry.

- Payment method support: White label payment processing supports many types of payment methods, including cards, digital wallets, and even region-specific bank transfer options. The greater variety you offer, the more you can improve the customer experience by supplying them with their preferred payment channels. Supporting diverse options also opens doors to markets where alternative payments dominate.

Disadvantages of white label payment gateways

- Lack of payment provider branding: Branding can be a double-edged sword when choosing your payment gateway solution. While it can be beneficial to offer a checkout experience that matches your company branding, there’s also a lot to be gained from maintaining the branding of your payment provider. Customers often feel more comfortable entering their payment details via a provider’s official interface. Disguising that provider entirely can lead to questions about the strength of your checkout security.

- Reputational damage: If a payment gateway has only your branding on it, then any problems with the gateway become your responsibility in the eyes of your customers. Should your provider experience downtime, outages, or worst of all, a data breach, your customers are going to assume the problem originates from your business, not the provider.

- Transaction fees: Though a white label payment gateway can help you save on the costs of developing an in-house solution, you may find that cost-effectiveness to drop when it comes to transaction fees. The trade-off for a fully-branded payment experience is often reflected in your cost-per-transaction, as white label providers may charge higher rates compared to their third-party counterparts.

- Multi-market support: Many white label providers tailor their solutions to specific markets rather than making their solutions globally compatible. This can work if you plan on staying within those markets, but if you want to expand into multiple regions, you’re likely to find white label payment gateways increasingly difficult to customise without additional tools and applications.

What is a white label payment gateway provider?

A white label payment gateway provider delivers ready-to-use white label payment gateway software that you can rebrand and advertise as your own.

Instead of developing and testing a gateway all on your own, specialised payment service providers offer secure payment solutions typically via SaaS (Software as a Service) platforms or applications. Many of these platforms can be integrated via API, making it easy to embed within your existing online storefront and checkout interface.

Processing online transactions under your own brand identity ensures your customers experience a seamless payment journey, all while relying on your provider behind the scenes to manage the more complicated back-end compliance and fraud requirements.

White label payment gateway providers vs. traditional gateway providers

| Provider type | Definition | Customisation | Customer experience |

| White label payment gateway providers | White label payment gateway providers offer their proprietary technology out-of-the-box, allowing merchants to present it as their own solution rather than an outsourced service. | Merchants gain full control over the gateway’s branding and design, but control of the back-end technology remains in the hands of the provider. | The customer experience on a white label gateway can vary depending on the customer’s trust level. If your company is not an established payment company, then customers may question the security of your gateway. |

| Traditional third-party payment gateway providers | Traditional providers offer payment gateway services via their proprietary technology, often with separate checkout interfaces that match their own branding. | A traditional provider maintains their own branding (such as colors and logos) on the gateway and checkout page. | Traditional providers offer a trustworthy customer experience but without any custom branding to associate the technology with your company. |

| Fully-integrated third-party providers | Fully-integrated third-party providers are rarer and offer merchants the opportunity to integrate a payment gateway directly in their website or app. | A fully-integrated provider, such as payabl., often combines their own branding with that of the merchant’s. The merchant can also gain more control over the back-end customisation, allowing them to use only the features they need most. | Fully-integrated providers focus heavily on creating a seamless customer experience that pairs your ideal payment experience with their own advanced technologies and features. |

Deciding whether to choose a white label payment gateway provider

If you’ve opted for a white label solution, choosing the right white label gateway partner is a decision that can impact every stage of your payment process.

Selecting the right white label payment gateway partner is your key to a seamless payment process.

Tailored white label payment processing combined with flexible white label merchant services make comprehensive payment solutions that not only enhance the customer experience but also give you total control over your brand and the user payment journey.

The provider you choose will shape your ability to deliver reliable payment solutions while offering payment services that meet both customer and merchant expectations.

The best white label payment gateway for your business should have the following features:

Customisation options

The ability to customise a white label gateway is vital for building a strong brand identity. Without these features, you face the complex and costly process of developing your own technology stack.

The right provider should let you design and personalise every stage of checkout. From branding to trust signals, your gateway should seamlessly handle customer payment details without disrupting user experiences. Subscription-based businesses should look for recurring payments support.

Integration capabilities

Operational efficiency requires optimal integrations. A good provider will offer a comprehensive range of integrations and plugins that fit directly into your existing ecommerce platforms of choice.

Your provider of choice should offer you a reliable payments infrastructure that can not only manage multiple integrations but also expertly handle surges in demand without downtime. A smooth integration process ensures you can implement the gateway quickly while minimising technical overhead. The easier the integration process, the faster you can launch in new markets or with new merchants.

Simple merchant onboarding process

A streamlined onboarding journey is crucial for growth. Delays can result in lost opportunities, so your provider should make the payment process as frictionless as possible. White label payment processing also means that the onboarding flow can be branded and tailored to your needs, allowing customers to initiate payments and save their credentials quickly.

When to choose a third-party payment gateway provider

Finding all of the features detailed above can be difficult when working with a white-label payment gateway partner, as this type of provider is mainly focused on front-end customisation.

Yet, choosing a third-party provider also requires careful consideration.

At payabl., we offer the advanced payment gateway you need for a fully-optimised checkout experience.

Unified dashboard & platform

Our unified dashboard is essential for managing the payment process at scale.

From a single platform, you can see all your transaction data in one place, including sales volumes, authorisation rates, and customer behaviours. This quality dashboard gives you clear visibility into your financial operations, reducing the need for multiple reporting systems.

Local payment methods supported

To expand globally, you must cater to the locals.

payabl. simplifies the payment process by supporting multiple local payment methods across different markets and currencies. Your customers should have the freedom of choice to pay through credit cards, digital wallets, bank transfers, or other various payment methods that are regionally popular. Offering local options helps you improve conversion rates and build trust.

Hosted checkout pages

Though payabl. may not offer a white-label solution, we do give you all the tools you need to incorporate your branding in the checkout and payment process. Our hosted payment pages can be customised to your branding and preferred payment workflows.

Choosing the right solution for your business

Just because a third-party payment gateway may not offer you total control over your gateway’s branding, these solutions are often the best option for businesses of all shapes and sizes.

While white label payment gateways may seem appealing for the promise of brand control, their limitations often outweigh the benefits. The lack of flexibility, potential reputational risks, and higher long-term costs can create more operational challenges than they solve, especially as your business grows in both size and payment volume.

A third-party payment gateway provider can offer you greater value and reliability, all while simultaneously delivering market-specific expertise that helps you expand your business across borders and into new regions. Still, you should be strategic in your choice of partner and opt for a provider like payabl. that can offer you the technology you need while still allowing you to customise key points in the payment journey, such as your checkout interface.

Activate your money flow with payabl.

payabl.one is your platform for all things financial management. Through solutions like payabl.checkout, you gain access to a customisable payment gateway with support for multiple payment methods, including digital wallets, payment links, and one-click payments.

Contact our team now to get started.

FAQ

Which is the most widely used payment gateway?

While it’s hard to say which payment gateway is the most widely used worldwide, some of the most popular gateways in Europe include payabl., PayPal, Stripe and Adyen.

Which payment gateway is best for small businesses?

payabl. is ideal for small businesses in Europe. payabl.checkout and the payabl.one platform help you gain control of your money flow to power business growth.

What is an example of a white label payment gateway?

Any payment gateway provider that offers white-labeling services is a white label payment gateway.

How much does it cost to create a payment gateway?

The cost of integrating a payment gateway can vary according to the provider’s pricing model. Building a gateway from scratch can cost thousands, while implementing a payment gateway solution from a third-party provider can be much more time and cost-efficient.

What are the benefits of white label and private-label models?

The primary benefit of a white label payment gateway is the freedom to add your own branding to the solution. However, it’s important to consider the drawbacks, such as potential damage to your reputation if the provider experiences an outage or breach.