At the same time, merchants can set up stores that operate 24/7, require minimal effort to keep operational, and lower their overheads while maximising their profits. But for a digital business to be successful, it needs one integral component– a secure, fast, and convenient way to accept payments.

Defining Payment Gateways

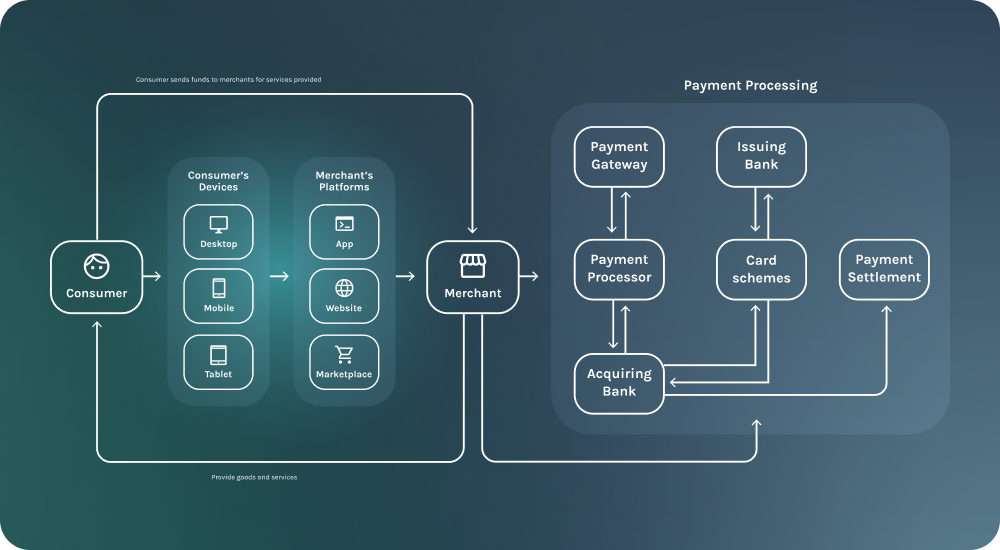

A payment gateway allows merchants to receive payment for goods or services rendered. A cash register would be an excellent example of a payment gateway in a traditional setting. A customer would pay cash, and it would put it into the cash register. A point-of-sale (POS) system is another good example for businesses that accept card payments. The merchant types in the payment amount and the customer can tap their card on the POS. The financial institution associated with the card will then either accept or declines the transaction instantly.

So how do payment gateways work in the digital space where customers can’t pay with cash or physically tap a card?

Enter the ‘Checkout Portal’. If you’ve ever bought anything online, then it's something you’d be familiar with.

Take the example of an online bookstore that accepts card payments. Customers will select a book, add it to their cart, and then head to the checkout page. They will choose their preferred method of payment, in this case a credit card, enter their card number, expiry, CSV and submit the details.

The payment gateway will then encrypt the data and send it to the payment processor to collect real-time financial information from the customer’s bank, including the funds balance and fraud checks and will then either accept the transaction and transfer the funds to the merchant account or decline the transaction.

All this happens in just a matter of seconds, usually without the customer knowing the complex processes happening behind the scenes to get that book from the store to their door.

Differentiating Payment Gateways

There are multiple types of payment gateways a merchant can choose from to suit their business's needs.

On-Site Payments

A website can have its own, self-managed payment gateway where the customer enters their payment information directly on the SSL merchant website and is not redirected anywhere else to complete the payment. This allows for more control over the look and feel of the payment interface and the overall customer experience.

While it is convenient to have the control, an onsite payment gateway can be costly and requires internal tech support and close attention to compliance, risk and regulation, so it’s generally used by larger businesses with high sales volumes.

Off-Site Payments

In this gateway, the customer completes the checkout process on the merchant’s website, but the payment is processed in the backend by the payments processor via a redirect to a secure payment page or gateway hosted by the payments processor to complete the transaction. The actual payment processing occurs on the backend of the payments processor's system, providing an extra layer of security for sensitive payment information. This method is commonly used for enhancing security and reducing PCI compliance requirements for the merchant.

Redirected Payments

In a redirect, the customer is redirected to an offsite payments processor such as PayPayl to complete the transaction. The customer is then redirected back to the merchant’s website. This method is simple to integrate and requires minimal internal support, however it can interrupt the customer checkout experience as there are additional steps to complete the final purchase, giving the customer more opportunities to abandon the cart.

Before choosing a payment gateway, consider the nature of your services/ products, projected sales volumes, and buyer personas. For example, if you offer low-cost goods with many substitutes, choose a fast and reliable gateway to avoid cart abandonment.

How to Choose a Payment Gateway?

The best choice is a gateway that can meet and exceed your customers expectations for a fast, secure and reliable checkout experience. So what should you as a merchant look for when shopping for a payment gateway?

Supported Payments

While an ideal payment gateway would accept all online payments, this is a hard ask. Most will support the standard payments in most regions, e.g., Visa or Mastercard, but to offer an even better checkout experience you should consider:

Where do your clients come from?

What payment methods do your clients favour the most?

Conducting market research and reviewing your website traffic and transaction reports can help you answer these questions objectively.

Location

Payment gateways are often specific to regions. For example, a popular U.S. gateway might not have the same traction in Europe and might have limited options for European clients. Finding a gateway that matches your geographic reach is best. We call this payment localization and it can be a powerful tool to supercharging both your domestic and international business growth, so be sure to check that your payment gateway call offer you the local or alternative payment methods your customers prefer to use.

Security

A payment gateway could have all the makings of a good option, but if it’s not secure, it’s not worth the risk. Fraud is one of the biggest risks to online merchants and every year fraudsters are becoming more and more sophisticated with their tactics. The backing of a steadfast payment gateway could mean the difference between the success of an online business or the financial ruin. Consider the security features included in the gateway and assess them per your projected security risks. Also look for a payment gateway that offers you the right level of support in case you are faced with these types of attacks.

Integration

The platforms on your site will affect the payment gateways you can introduce, as they can hinder smooth integration. The best approach would be to choose a gateway before building a site, but if the site is running, you should find a gateway that matches the existing platforms to ensure the transactions are fast and secure. Luckily, many gateways allow merchants to customise the features for easier integration, which preserves the site's stability. A good example would be the payabl. plugin, which you can integrate with an active website.

Cost

Clients want to avoid surprise charges or significant transaction fees that bite into their finances. Consider gateways that charge minimal fees to reduce cart abandonment rates and increase customer retention, but don’t settle for an unsuitable payment gateway. The costs resulting from security breaches are much higher than you’d pay for a secure and reliable gateway. Also, consider whether the gateway is customisable per your preferences to make it more intuitive for your clients.

Settling the Debate: Payment Gateways vs. Payment Processors

Often the terms payment gateways and payment processors interchangeably, but are they the same? Not at all.

A payment gateway collects payment details from customers. It’s the method of obtaining the sensitive payment information and encrypting it to be sent for processing.

The payment processor receives the encrypted payment information from the gateway and contacts the customer’s bank to debit the payment and transfer the funds to the merchant’s account.

payabl. combines both services, acting as both a payment gateway and payments processor, enabling the business to accept online payments from global clients without relying on several integrations. This fully regulated payment gateway offers hundreds of payment solutions, boasts one-click payments to reduce cart abandonment rates, and allows you to accept recurring payments.

Finding the right payments solution for your business can be tricky. Contact us and we can work together to tailor a payment stack to suit your business needs.