The credit card goes beyond modern-day economics and the format in which we know this payment medium today. This Buy Now, Pay Later (BNPL) concept finds its roots in ancient times – going as far back as 4500 BC – and has evolved through the ages to adapt to changes in global economic infrastructures and technology, as well as changes in people’s financial needs and purchasing habits.

Read on to find out how credit cards work and the advantages they offer to customers and merchants today. We also answer some important questions often asked about credit cards.

What is a credit card? Definition and key components

A credit card is an electronic card, usually made from plastic (earning it the nickname “plastic money”), which allows a person to borrow money in order to complete a sales purchase.

The cardholder is issued a credit card by a banking institution, often called an issuing bank, which in turn allows the cardholder to make purchases against a credit limit on their card. This eliminates the need for cash at the point of sale.

Purchases accumulated on the credit card are then paid back to the bank by the cardholder at pre-agreed time intervals. If those payment deadlines are not met, the cardholder has to pay additional charges, often called interest, for ‘borrowing’ this money to make purchases. It’s similar to how a loan works.

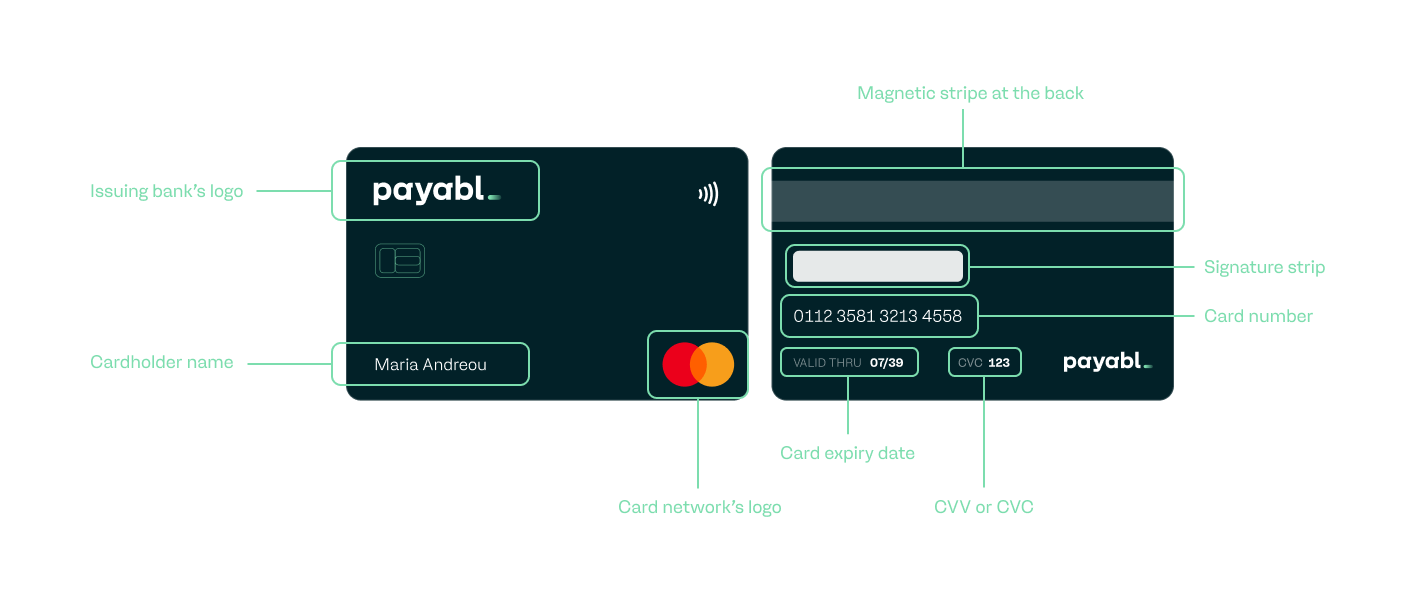

What information is displayed on a credit card?

- Cardholder name

- Card number

- Card expiry date

- Issuing bank’s logo

- Card network’s logo

- Magnetic stripe at the back

- CVV or CVC

- Signature strip

How does a credit card work?

Now that the basic definition is out of the way, let’s talk about the technology and the logic that makes credit cards work, as well as some common concepts that cardholders often want to know about.

The technology behind credit cards

Once credit cards became popular as a concept, technological innovation transformed the appearance and capabilities of this cashless payment instrument. One of the most significant advancements was the addition of the magnetic stripe to plastic cards. The magnetic stripe had the ability to make electronic transactions quick and easy by storing data through magnetic recording.

Fast forward a few years into the third millennium, technologies like EMV were created to substantially change the credit card once again. EMV chip technology got its name from its original inventors Europay, Mastercard, and Visa. It involves the use of microprocessor chips to store and protect credit card data – a massive step up from the magnetic stripe. Now widely used in both credit cards and debit cards, EMV chips help reduce card fraud, enable safer transactions, and ensure global interoperability.

The logic that drives credit cards

A person wishing to use a credit card as a payment medium begins by requesting a new card by submitting an application to the credit card issuer.

During the application process, the issuing bank asks the potential cardholder for information regarding their identity, citizenship, residency, employment, and income. Based on various credit scoring methods and other vetting processes, the bank either approves or rejects the application.

If the issuer reviews the customer’s profile and approves them, they will be given a credit card of a certain limit that will determine how much they can spend on credit for online and offline purchases.

Each month, the issuing bank then provides an invoice outlining all purchases made within the billing cycle. This is usually a period of 27-31 days depending on the card issuer’s policies and terms. The invoice helps the customer learn about all the purchases they made within their billing cycle and what their credit card balance is. They will be required to make a minimum payment for each billing cycle.

How does credit card interest work?

The purchases a customer makes on a credit card are essentially money borrowed from the issuer. The APR is the interest rate paid on credit card balances that are not repaid within the grace period that credit card issuers specify. This is stated as a yearly rate.

The final APR assigned to a credit card contract can be influenced by a number of factors, such as the customer’s creditworthiness, credit history, and the prime rates of the central bank. APRs vary widely between credit card issuers, and they can range from anywhere between 10% and 25%. APRs can also be subject to change in the future, as lenders (or issuers) can also raise the APR if a borrower's credit gets worse, or if the national interest rate increases.

Common terms of repayment

Cardholders are often given two options for repayment.

a) They can pay their balance in full, which means clearing their credit card bill in one go

b) They can carry a balance by paying the minimum amount by the credit card payment due date. Depending on their credit card agreement terms and conditions, carrying a balance usually means incurring fees and charges for the revolving credit facility they use.

Types of credit cards

Secured credit card

A secured credit card is one that is usually issued to people with poor or no credit history. The issuers of secured credit cards will usually ask for a security deposit or collateral on the account, and the credit limit is usually set at the same value as the deposit amount, or sometimes a fraction of it.

Unsecured credit card

An unsecured credit card is the most common type of credit card, and it is not secured by any type of collateral. The approval and credit limit for this type of card is based on factors like credit score and risk analysis, which the card issuer assesses.

Balance transfer credit card

In some cases, cardholders looking for lower APR alternatives to their existing credit agreements will take their outstanding balances on their existing credit cards and move them to another credit card provider with a lower APR. Lower balance transfer APRs are a marketing tool that many credit card issuers use to attract new customers.

Rewards credit card

A rewards credit card offers customers perks like bonus points, miles, and cashback on purchases. These can be redeemed for various benefits such as travel, merchandise, or statement credits.

Store credit card

A store credit card is a credit card issued by a specific retailer, which the customer can only use at the brand’s various locations. It offers specific discounts and rewards for credit card purchases made with that retailer.

Business credit card

A business credit card is designed for business expenses and offers special features for businesses to benefit from, such as higher credit limits, expense tracking, and rewards on business-related purchases.

The pros and cons of using credit cards

Both customers and merchants can gain numerous advantages from using credit cards, but they can also have some downsides.

Pros and cons of credit cards for customers

Advantages | Disadvantages |

|---|---|

Flexibility in payment | Risk of falling into debt cycle |

Widely accepted by many merchants globally | Late fees and other complex charges |

No need to carry cash | High annual fees |

A change to build credit history for future credit investments | Foreign transactions can be expensive |

Special rewards and offers | Impulse buying |

Fraud prevention |

|

Advantages of credit cards for customers

- They offer payment flexibility to customers in instances when necessary funds may not be immediately available.

- They are a widely accepted payment method, offered by many merchants all around the world.

- Eliminating the need for cash makes credit cards a convenient payment method.

- They offer one of the easiest ways for customers to build a positive credit history and improve their credit score with timely repayments, so they can apply for bigger loans and even mortgages.

- Many credit card schemes offer amazing rewards, loyalty points, discounts, and more, resulting in significant cost savings.

- The fraud prevention mechanisms put in place by credit card services work to protect customers from falling victim to various kinds of payment fraud, particularly those involving unauthorized payments.

Disadvantages of credit cards for customers

- Credit cards require customers to be vigilant if they want to ensure that they don’t end up falling into a debt cycle.

- If customers are late with payments or fail to understand the payment terms, they can rack up a high amount in interest and other charges.

- Premium cards often charge high amounts in annual fees.

- Foreign transaction fees can be quite high depending on where the customer originally resides and got the credit card in.

- A fairly recent scientific study by MIT Sloan School of Management revealed how using a credit card leads to impulse buying and overspending by exploiting the reward center of the brain.

Pros and cons of credit cards for merchants

Advantages | Disadvantages |

|---|---|

Boost revenue and profits | Transaction fees can be high |

Higher customer satisfaction | Chargeback risk |

Incentivize customers to place larger orders | Compliance can be difficult |

Lower chances of error |

|

Easy to manage reward programs |

|

Digitalization allows better data analytics and decision-making |

|

Advantages of credit cards for merchants

- By offering payment flexibility to customers, credit card payments can boost revenue and profits for merchants.

- Offering credit cards as part of a holistic payment strategy keeps customers happy as they have the freedom to pay via a method of their choice.

- Customers with decent credit limits are able and encouraged to make larger transactions, boosting the average order value for merchants.

- Digitalized payments in the form of credit cards eliminate certain errors and risks that cash transactions are prone to.

- It is easy to offer and manage various reward programs to customers with a store credit card.

- If you use the right tools and platforms to manage your customers’ credit card transactions, you will be able to keep an accurate record of sales and be able to use this data for advanced analytics, reporting, and decision-making.

Disadvantages of credit cards for merchants

- Payment aggregators and card networks may charge significant transaction fees in exchange for their card payment processing services.

- In case of friendly fraud, chargeback claims are often decided in the favor of the customer, causing the merchant to incur chargeback fees along with losing revenue.

- Ensuring compliance with all the different financial and payment regulations, such as PCI DSS (Payment Card Industry Data Security Standard) and PSD2 (Payment Services Directive), can be challenging. Non-compliance can result in heavy penalties. Thus, it’s crucial to partner with a reliable payment gateway, acquirer, processor, or aggregator, depending on the services required.

Frequently asked questions

There is a lot that needs to be answered, explained, and defined when it comes to credit cards. This section will address some of the most common queries.

How long does it take to get a credit card?

The process in obtaining a credit card can vary depending on a number of factors, such as the type of credit card that the customer is applying for, whether they are going through an online application process or via the mail, the type of credit score required for the type of credit card they want, and so on. Simply put, each issuer has different processes and timelines in approving an application for a credit card.

What is a credit limit?

Credit limit is the maximum amount of money a cardholder can borrow against a credit card for their purchases. It is typically set when their credit card application is first approved. If they reach that limit within a payment cycle, they will be said to have “maxed out”. Repeatedly maxing out a card can reflect badly on the cardholder’s credit score.

What is a credit card balance?

The balance of a credit card refers to the amount the cardholder owes on their credit card account at the end of their billing period. If they make a payment towards a credit card balance, the balance is reduced. Any remaining amount gets carried over to the next month's billing period and determines how much the customer has left to spend against their credit limit.

What is CVV on a credit card?

CVV refers to the three-digit number on the back of a Visa or Mastercard credit card or the four digits appearing at the front of an American Express above the credit card number. CVV stands for Card Verification Value. It is also known as card verification code (CVC) or card security code (CSC).

The CVV is a security feature used in transaction processing to protect the cardholder against fraud, particularly in card-not-present (CNP) transactions such as online or over-the-phone purchases. It helps verify that the cardholder is in possession of their actual credit card when making the payment.

Can you withdraw cash using a credit card?

It’s possible, but not recommended.

Most card issuers allow users cash advances via ATM withdrawal, but they also charge a hefty cash advance fee on it. Therefore, it is not the best idea to use a credit card to withdraw cash.

What constitutes credit card fraud?

Credit card fraud occurs when an unauthorized transaction takes place on an account without the cardholder’s permission. When a credit card or its details are lost or stolen and used without the consent of the cardholder, the transactions carried out by the perpetrator are then deemed fraudulent and are eligible for refund (chargeback) after a thorough investigation by the issuing bank or credit card company.

What is a grace period?

A grace period is the time interval a customer is allowed until they make their credit card payment, without incurring interest and fees.

How do you determine the APR on a card?

Every potential credit card holder should be aware that the convenience of using revolving credit comes with a price, in the form of annual percentage rates (APR) and monthly charges. Issuers have a duty toward the consumer to thoroughly have the credit card APR explained before issuing a credit card to its user.

What is the relationship between a credit card acquirer and credit cards?

A credit card acquirer, aka a merchant acquirer, is a merchant bank or other financial institution that is a principal member of Visa and Mastercard. An acquirer utilizes a secure payment gateway to process credit card payments received by merchants from cardholders.