Wero is a European digital wallet built on instant account-to-account payments that lets people pay directly from their bank account to a merchant’s account.

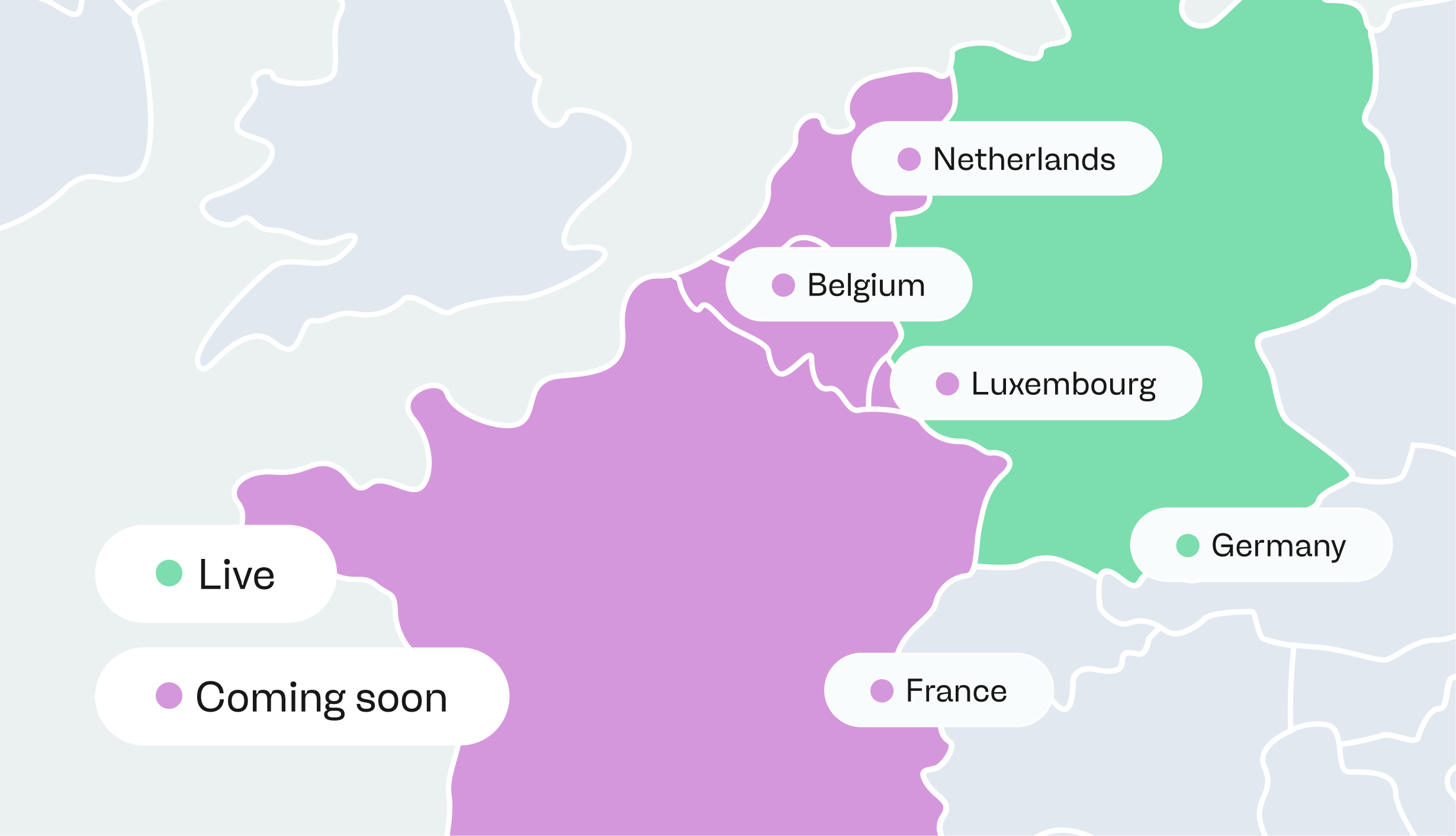

It is powered by the European Payments Initiative (EPI) and designed to provide a unified payment experience across multiple countries, including Germany, France, Belgium, the Netherlands and Luxembourg, with expansion into other markets planned. Wero aims to simplify payments in key EU markets while reducing reliance on traditional card networks.

At payabl. we see Wero as part of a broader evolution in European payments rather than a standalone trend. It creates an opportunity for merchants to improve conversion, reduce cost pressure and reach consumers in the ways they prefer to pay.

This guide explains what Wero is, how it works, and what merchants should consider.

Short on time? Download our Wero one-pager for a concise overview.

What is Wero today?

- Wero is a mobile wallet and payment scheme built on instant account-to-account technology running on SEPA rails.

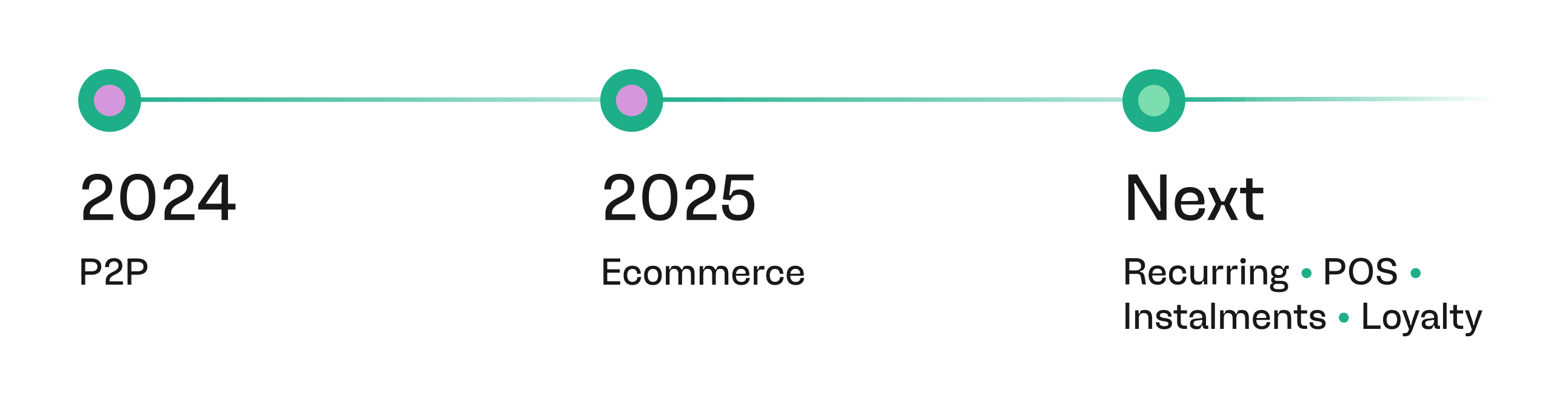

- It started with person-to-person use and is now extending into merchant payments, online and in-store.

- It is backed by major European banks through the EPI, with the goal of reducing fragmentation in the payments landscape.

- Wero lets customers pay using their phone or banking app without needing cards or separate account balances.

- Wero is increasingly available in major European markets and expanding its support for e-commerce checkout and point-of-sale use cases.

Growing European coordination

In February 2026, the EPI signed a memorandum of understanding (MoU) with a group of major European domestic payment schemes, Bancomat in Italy, Bizum in Spain, SIBS-MB WAY in Portugal and Vipps MobilePay in the Nordics, to explore closer alignment of sovereign, pan-European payment solutions.

What the MoU is about

The agreement is designed to accelerate the rollout of interoperable, cross-border payment infrastructure across Europe. The parties aim to improve technical interoperability between their respective solutions and make it easier for users to send and receive payments across borders.

Under the terms of the MoU, the schemes will work together to develop shared standards and explore common technical foundations, with the ambition of enabling seamless cross-border transactions by around 2027.

Roadmap and next steps

Following the MoU, the partners will establish the central interoperability entity by H1 2026, they will start preparing the technical implementation of the target set-up, and conduct proofs-of-concept in parallel.

Coverage of all use cases is intended by 2027 through a phased rollout:

- In 2026: rollout of peer-to-peer (P2P) cross-border payments

- In 2027: rollout of e-commerce and point-of-sale (POS) payments

How Wero works at the checkout

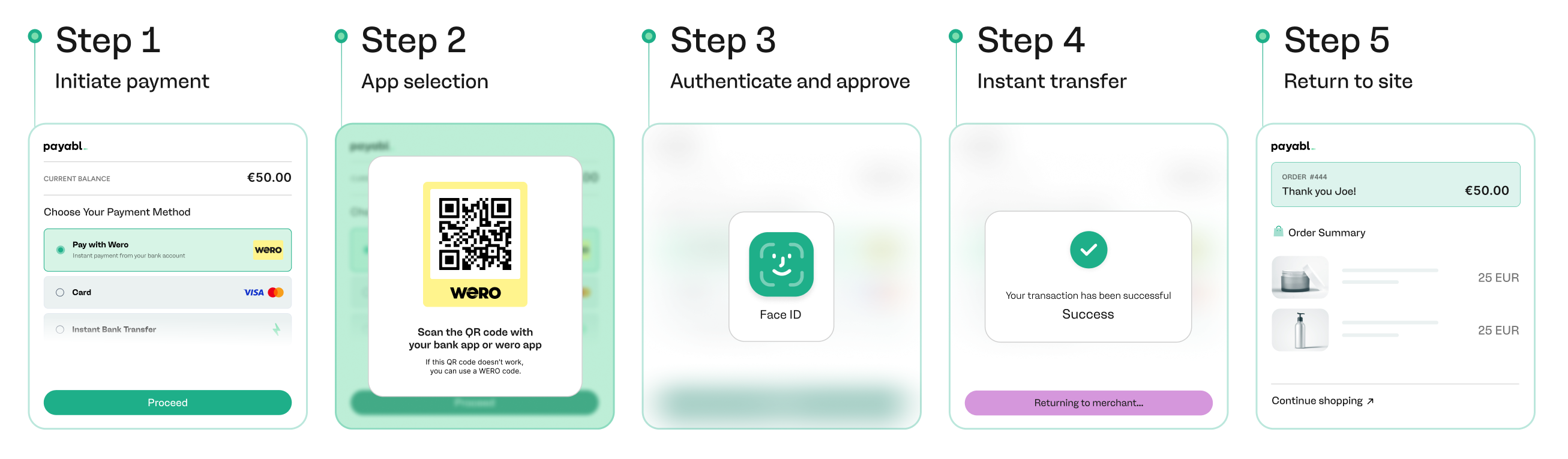

Customer experience

- Initiate payment: Customer selects Wero at checkout.

- App selection: Customers are redirected to their banking app or the Wero app on their smartphone.

- Authenticate and approve: The customer securely authenticates the payment using their banking app’s login or biometrics.

- Instant transfer: Funds are instantly debited from the customer’s bank account, and the transaction is completed.

- Return to site: The customer is returned to the merchant’s site with real-time confirmation of the transaction.

- This payment flow employs bank authentication and SEPA Instant, meaning there is stronger security and immediate clarity on payment status.

How merchants enable Wero

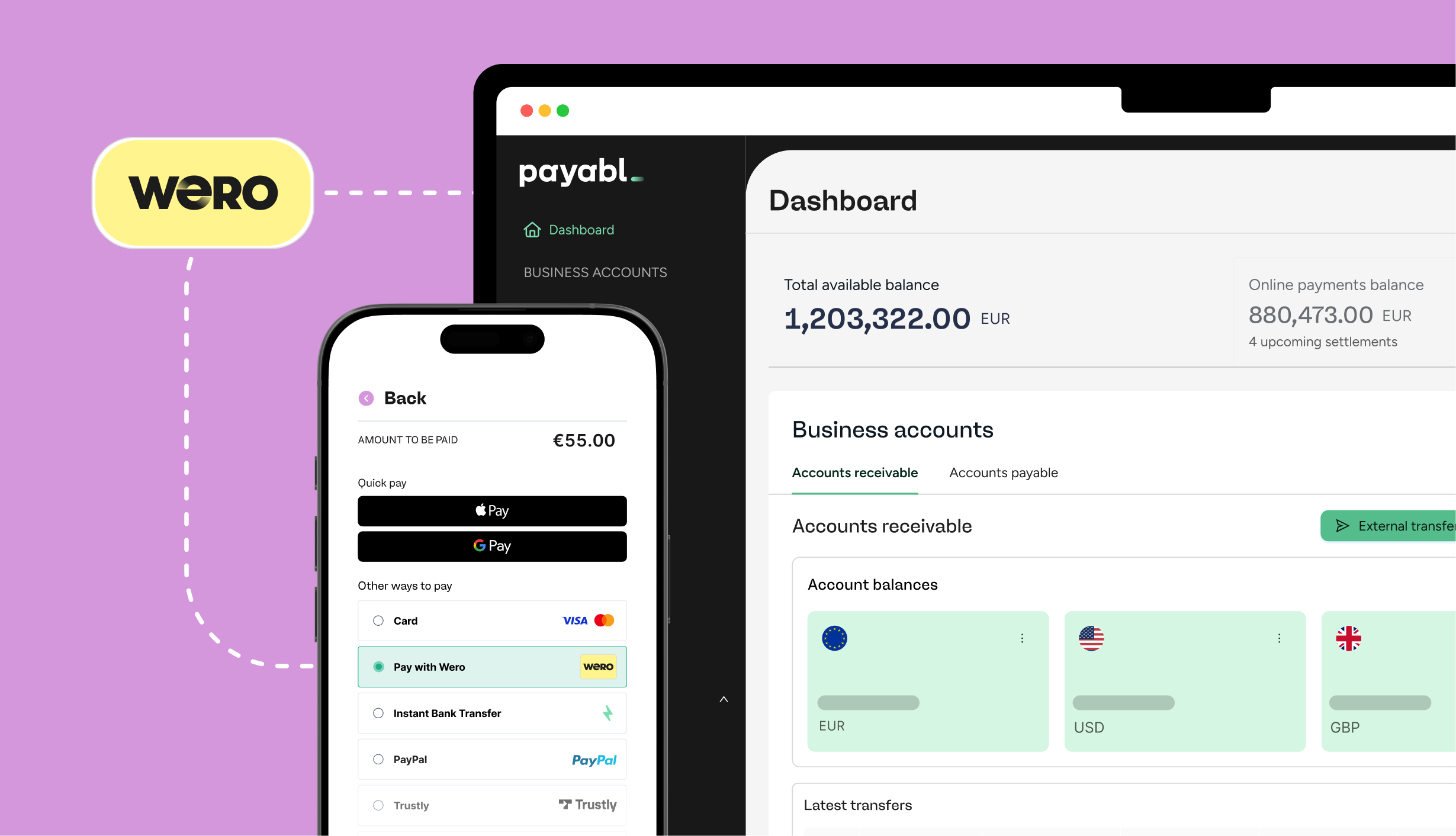

Merchants can enable Wero through a payment service provider that supports it, such as payabl.

With payabl., Wero can be added via a single integration alongside cards and other local payment methods. There’s no need for separate contracts or fragmented reporting.

With payabl.one, merchants can:

- View Wero transactions in real time

- Track settlement status

- Monitor disputes

- Reconcile at transaction level

- Analyse performance alongside other payment methods

This means Wero becomes part of your existing payment stack, not an operational silo. If you want to explore Wero acceptance, you can learn more here

What this means for merchants

Faster payments and settlement clarity

Wero’s instant account-to-account model means money moves quickly, with confirmation arriving in real time. This can improve cash flow visibility and reduce reconciliation delays when compared with slower settlement cycles on other rails.

Conversion and friction

Customers increasingly choose payment options that feel fast and familiar. Offering Wero in key markets can reduce checkout friction and increase conversion rates among consumers who prefer bank-based payment experiences.

Cost pressures

Wero bypasses many intermediaries involved in card processing. While economics will vary by market and PSP arrangement, account-to-account models can create downward pressure on costs versus legacy card interchange.

Dispute dynamics

Wero does not follow traditional card chargeback processes. Disputes and reversals are handled through bank-centric flows, which can change operational risk exposure and recovery processes.

Cross-border alignment

Because Wero is intended to work across multiple EU markets with a single standard integration, merchants that sell internationally can offer a consistent local payment experience without country-by-country method integration.

Practical considerations before you enable Wero

Integration and stack readiness

- Ensure your checkout platform or PSP supports Wero.

- Plan for unified reporting and reconciliation.

- Confirm how refunds are processed and displayed in your accounting or ledger workflows.

- Test the UX flow to ensure it aligns with your overall checkout design.

Consumer expectations

Wero must feel as seamless as other popular digital wallets. In markets where local payment preferences are strong, localised options like Wero can drive better engagement.

Data and privacy

Wero is built in compliance with EU standards for strong authentication and data protection. This is important for maintaining customer trust and ensuring regulatory alignment.

What the future may hold

Long-term, Wero is building out a broader set of payment features. The goal is not just instant bank transfers, but a full wallet that supports everyday commerce use cases.

Here’s what’s planned.

Faster repeat checkout

- Consumer-present future payments: This is Wero’s version of card-on-file or one-click payments. A customer gives consent once, and future purchases can be completed with less friction. For ecommerce merchants, this is key to improving repeat purchase conversion.

- Consumer-absent future payments: Payments made when the consumer is not present at the merchant's location during the transaction. These transactions are processed remotely; online, over the phone, or via mail.

- Wero user profile: A device-independent identity layer designed to reduce redirect friction and simplify login at checkout. The aim is to make Wero feel faster and more seamless for returning customers.

More flexible payment models

Recurring payments

Managing subscriptions for services such as streaming platforms, SaaS tools or gym memberships. Customers authorise once, and payments continue automatically.

Deposits and reservations

Holding funds for car rentals, hotel bookings or equipment hire. This supports industries that need pre-authorisation before final settlement.

Instalments

Allowing customers to split payments over time, either through bank-backed instalment models or integrated financing options.

Variable payments

Reserving a maximum amount before a service begins and capturing the final amount afterwards. Think EV charging, fuel, mobility or usage-based services.

One-click payments

Authorising future payments with a one-time consent model, enabling faster checkout for repeat customers and reducing redirect friction.

Payment protection

Handling no-show fees or cancellation charges, particularly relevant for hospitality businesses such as restaurants and hotels.

In short, Wero is moving beyond simple account-to-account transfers. It is building the features merchants need to support real-world commerce, both online and in-store.

It will not replace every existing rail. But as these capabilities mature, it becomes a more complete alternative within a diversified payment stack.

How Wero compares to Europe’s leading payment methods

Merchants don’t evaluate payment methods in isolation. Wero won’t replace your entire checkout. It will sit alongside cards, wallets and alternative payment options.

To understand where Wero fits, it helps to compare it directly with the methods most European merchants already use: PayPal, card payments, Apple Pay, Google Pay, and buy now, pay later providers.

Each solves a different problem. Some optimise convenience. Some increase the basket size. Some reduce cost pressure. Wero’s role is to strengthen the bank-based segment of your payment mix while aligning with Europe’s instant payment infrastructure.

Here’s how they stack up:

Feature | Wero | PayPal | Cards (Visa / Mastercard) | Apple Pay / Google Pay | BNPL (e.g. Klarna, Affirm) |

| Core model | Instant account-to-account | Digital wallet | Card network | Wallet on top of cards | Instalment financing |

| Funding source | Bank account | Stored balance, bank or card | Credit / debit card | Card stored in device wallet | Financing provider |

| Geography | Core EU markets (expanding) | Global | Global | Global | Market dependent |

| Checkout experience | Bank app redirect | Embedded wallet login | Card entry or stored card | Biometric device authorisation | Redirect / embedded flow |

| One-click / repeat payments | Developing via consent model | Yes | Yes (card-on-file) | Yes | Yes |

| Settlement confirmation | Instant (SEPA Instant) | Instant authorisation | Instant authorisation | Instant authorisation | Instant authorisation |

| Settlement speed to merchant | PSP dependent | PSP dependent | PSP dependent | PSP dependent | PSP dependent |

| Cost structure | A2A pricing, no interchange | Wallet fee model | Interchange + scheme fees | Card-based (interchange applies) | Merchant discount rate |

| Chargebacks | Bank-based dispute process | PayPal dispute process | Card chargeback lifecycle | Card chargeback lifecycle | Provider-managed risk model |

| Credit offering | Not core (exploring) | PayPal Credit in some markets | Credit via issuer | Credit via issuer | Core feature |

| Consumer trust | Bank-backed, growing | Very high | Very high | Very high | High in certain verticals |

| Best for | EU bank-based payments, cost diversification | Conversion and global wallet adoption | Universal acceptance | Mobile conversion optimisation | Increasing basket size |

How payabl. helps you unlock Wero

payabl. is one of the first European payment providers that enables merchants to accept Wero. We help you integrate Wero through a single API, with visibility of performance in unified reporting and payment optimisation without adding operational complexity.

If you want to learn more about how Wero can help your business improve conversion and reduce payment costs, start here: Explore Wero with payabl.

Wero FAQ for merchants

What is Wero in simple terms?

Wero is a European wallet that allows customers to pay directly from their bank account using instant payment infrastructure. Instead of entering card details, customers confirm the payment in their banking app or the Wero app, and the transaction is completed in real time.

Is Wero the same as iDEAL?

No, but they are connected.

In the Netherlands, iDEAL is transitioning into iDEAL | Wero as part of a phased migration. Over time, Wero will replace iDEAL branding while expanding the functionality beyond the Netherlands into other European markets.

For Dutch merchants, this means continuity for customers, with broader European potential in the future.

Where is Wero available?

Wero is currently rolling out across:

- Germany

- Austria

- France

- Belgium

- The Netherlands

- Luxembourg

Availability continues to expand market by market as banks and PSPs enable merchant acceptance.

How does Wero differ from card payments?

The key differences are:

- Wero is account-to-account, not card-based.

- There is no traditional interchange model.

- Authentication happens at bank level.

- Confirmation is instant through SEPA Instant rails.

The economics and dispute processes differ from traditional card schemes.

Is Wero cheaper than cards?

That depends on your PSP pricing and transaction profile.

Because Wero does not operate on a traditional interchange structure, it can introduce cost efficiencies compared to cards. However, final pricing varies by provider and volume.

Merchants should model Wero alongside their existing payment mix to assess impact.

Does Wero support refunds?

Yes.

Refunds are supported, but the operational process depends on your PSP integration. It is important to confirm:

- How refunds are initiated

- Whether they are instant

- How they appear in your reconciliation reports

Your PSP should provide clear reporting on refund status.

How do disputes work with Wero?

Wero does not follow the traditional card chargeback lifecycle, but it is still a similar process - it has been adjusted to EPI scheme standards.

Disputes are handled through bank-based processes rather than card scheme arbitration. This changes how disputes are initiated and resolved.

Merchants should ensure they understand how disputes are surfaced and tracked through their PSP dashboard.

Does Wero support subscriptions or recurring payments?

Wero is developing consent-based future payment models designed to support repeat purchases and subscription-style payments.

Under this model, customers provide one-time authorisation, allowing smoother repeat transactions.

Availability may vary by market and integration stage, so confirm capabilities with your PSP.

Is Wero secure?

Yes.

Wero uses bank-level authentication and operates within EU regulatory frameworks, including strong customer authentication requirements.

Because payments are authorised directly within the customer’s banking environment, security standards are aligned with regulated financial institutions.

Will Wero replace cards?

Unlikely in the near term.

Wero is best viewed as an additional rail within a diversified payment strategy. Cards will remain important, but Wero strengthens the account-to-account segment and reduces reliance on a single network.

Should I add Wero to my checkout?

You should consider adding Wero if:

- You sell into Germany, Austria, France, Belgium or the Netherlands

- A significant share of your customers prefer bank-based payments

- You want to diversify payment rails

- You are looking to optimise costs and reduce card dependency

The best approach is to test Wero alongside your existing methods and measure performance.

How do I enable Wero?

You can enable Wero through a PSP that supports it, such as payabl.

With payabl., Wero can be integrated via a single API, included in unified reporting, and managed alongside your existing payment methods.