Important update: Fraud-related disputes resolved through Rapid Dispute Resolution (RDR) will no longer be excluded from the VAMP ratio calculation. Read our section on exclusions for more details.

Fraud and disputes continue to be a headache for merchants. In 2023 alone, global payment card fraud losses skyrocketed to $33.8 billion, according to the Nilson Report. Disputes are also expected to rise as consumers become more comfortable with challenging transactions.

Visa is stepping up its efforts to combat these threats with an enhanced Visa Acquirer Monitoring Program (VAMP), launching on April 1, 2025. This update consolidates multiple fraud and dispute programs into one, making it critical for merchants to adapt or face financial consequences.

So, what exactly is changing, and how can you safeguard your business? Learn how VAMP will impact you and how payabl. can help merchants navigate these changes with ease.

Understanding the rationale for a VAMP revamp

Visa has spoken extensively about the ‘collective calling’ it has with its clients to protect each and every party in the payment journey–from acquirers and issuers to merchants and consumers–from fraudulent activity.

VAMP was originally introduced to create more seamless controls and processes for acquirers and merchants to deter fraud and enumeration, and effectively manage disputes, contributing to a much more secure environment. Sometimes referred to as card testing, enumeration transactions are performed by fraudsters to validate and identify stolen card details.

With the upcoming VAMP update, the company is merging its existing Visa Dispute Monitoring Program (VDMP) and Visa Fraud Monitoring Program (VFMP) into one streamlined system.

VAMP will create globally aligned fraud thresholds for both domestic and cross-border card-not-present (CNP) transactions, to provide clarity and consistency to acquirers and their merchants. It will also incorporate enumeration criteria based on the number of enumerated authorisation transactions and enumeration rate, to help foster and promote best practices that protect against this expanding attack vector from sophisticated fraudsters.

Ultimately, Visa hopes will lead to more comprehensive fraud prevention across the cross-border ecosystem.

What does VAMP mean for merchants?

Staying ahead of these changes can protect your business and improve customer trust.

Dispute thresholds will be shifting, with the various metrics from the other programmes combining into what Visa classes as a ‘more rounded payment integrity approach’. Some requirements are being streamlined, and the company is also pushing its dispute resolution tools more prominently.

For the purposes of calculating the new VAMP rates and enumeration rates, only CNP transactions, domestic, and cross-border transactions will be considered. To be considered for VAMP, a merchant needs to have a minimum of 1000 combined fraud reports and non-fraud disputes each month, which are then used to calculate the VAMP ratio.

Here are the VAMP developments you need to familiarise yourself with:

Monitor and reduce chargebacks

The dispute threshold will drop to 0.9% by 2026, making it more important than ever to have robust chargeback prevention strategies. payabl. provides the tools and insights merchants need to lower chargeback rates and maintain compliance.

Fraud detection must be a priority

The new enumeration ratio means merchants who experience frequent fraudulent attacks—such as card testing—could be penalised. Implementing strong fraud detection measures will be crucial to avoiding VAMP enrolment.

You won’t get a second chance

Visa is eliminating the ‘above standard’ warning stage, meaning merchants will immediately be classified as excessive if they exceed dispute or enumeration thresholds. Being proactive is key.

How are VAMP ratios calculated?

To better prepare for the upcoming changes, merchants should understand how Visa calculates the VAMP ratios that determine program eligibility. Here’s a clear breakdown:

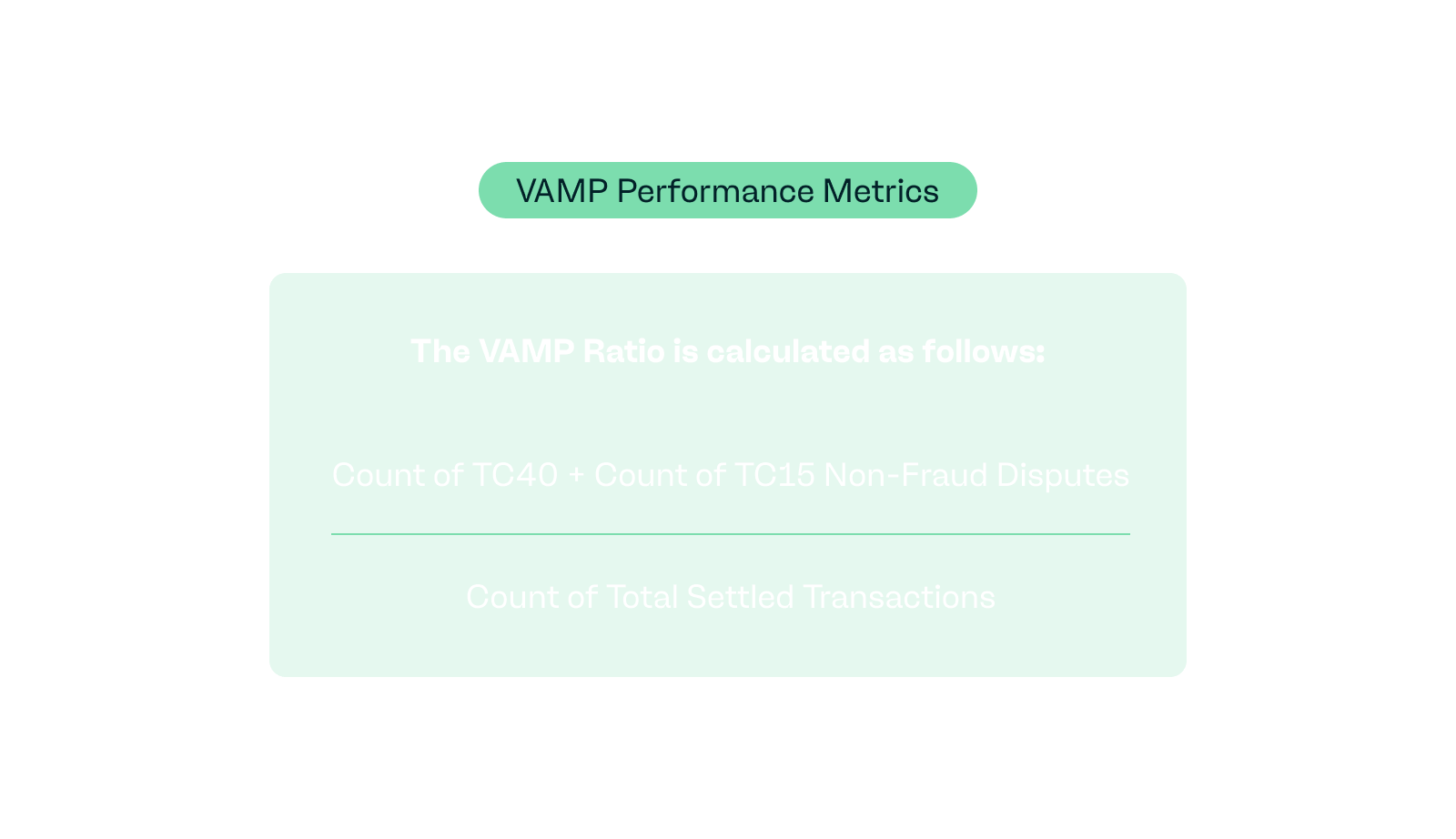

The VAMP ratio

The VAMP Ratio is calculated as follows:

This formula accounts for both fraud and non-fraud disputes (TC40 and TC15), dividing their total count by the number of total settled transactions.

This formula accounts for both fraud and non-fraud disputes (TC40 and TC15), dividing their total count by the number of total settled transactions.

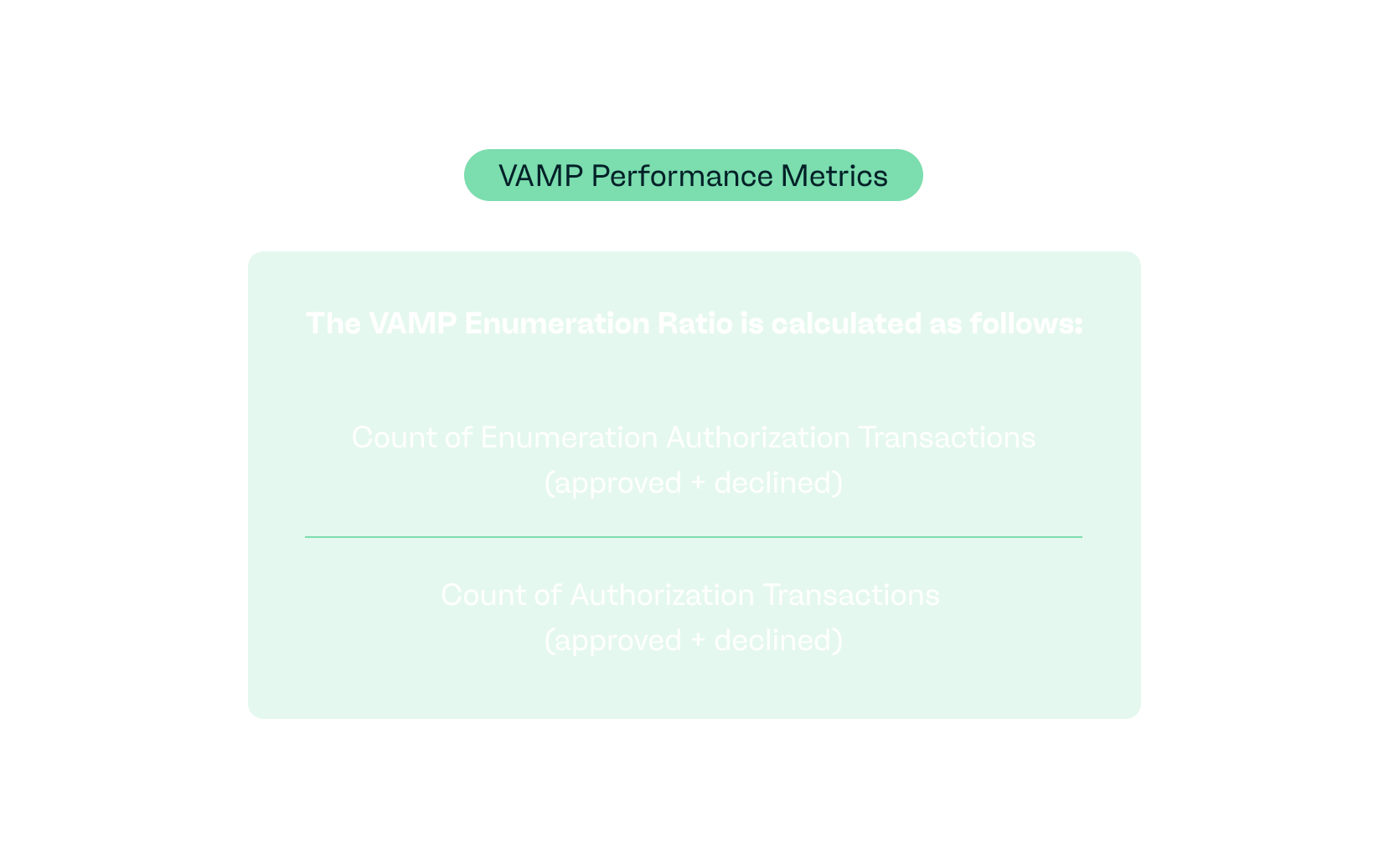

The enumeration ratio

Visa has also introduced the Enumeration Ratio to track card testing attacks. It is calculated as:

This ratio looks at the percentage of enumerated authorisation transactions (both approved and declined) out of the total number of authorisation transactions submitted by the merchant. Understanding these metrics is critical for merchants looking to ensure compliance and avoid penalties under the VAMP initiative.

Transactions excluded from VAMP calculations

Merchants should also note that certain transactions will not be included in VAMP calculations.

Specifically:

Non-fraudulent TC15 disputes that have been resolved through Resolved Dispute Resolution (RDR) alerts.

Transactions supported by Compelling Evidence 3.0, Visa's enhanced process for providing additional evidence to challenge disputes successfully.

Whilst Visa initially planned to exclude all transactions that have been resolved through Resolved Dispute Resolution (RDR) alerts from its calculations, this is no longer the case. According to an update from Visa on March 11, 2025, using RDR to resolve a fraud-related dispute or fraud reports will no longer exclude that transaction from the VAMP ratio calculation.

Non-fraud disputes resolved through RDR will still be excluded, as will fraud-related disputes resolved using one of the other methods.

These exclusions are important for merchants to understand, as they can influence dispute ratios and eligibility under the program. By leveraging these tools effectively, merchants may reduce their likelihood of exceeding VAMP thresholds.

How payabl. can help you stay compliant and protect your revenue

At payabl., we understand that Visa’s evolving fraud and dispute management landscape can be complex. That’s why we’re here to help merchants mitigate risks, reduce fraud, and navigate the new VAMP framework with confidence.

Our solutions help businesses:

- Reduce fraud rates with advanced detection and prevention tools

- Lower chargeback ratios by providing dispute resolution strategies

- Ensure VAMP compliance with expert insights and tailored support

Get in touch with payabl. to discuss how we can help you future proof your payments strategy and stay ahead of fraud threats.