Europe’s digital payments market is booming, with online payments accounting for a daily average of 21% of all transactions throughout the region. These online payments make up 36% of the total financial value passing through businesses on a day-to-day basis.

An inability to accept online payments can greatly harm and hinder your revenue. To capitalise on the continuing rise of digital transactions, the first critical step is integrating a payment gateway.

Accepting payments in a cost-effective manner requires a strong understanding on the payment integration process and how to optimise it.

What is payment gateway integration?

The payment gateway integration process connects websites or applications, such as ecommerce stores or marketplace apps, to payment gateway solutions.

A payment gateway acts as a digital bridge between the merchant’s financial system and their payment processing provider, and the integration process is what builds this bridge. Secure online payments require this process to ensure the safe and efficient capture of customers’ payment information.

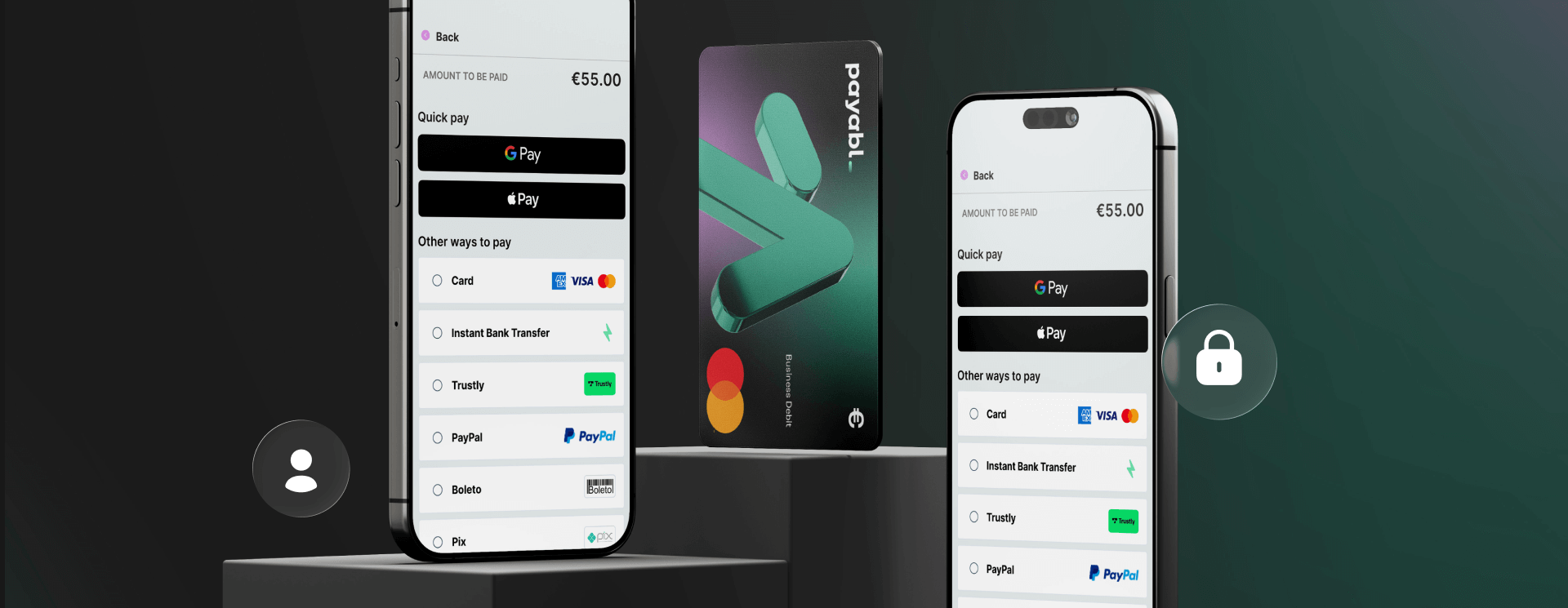

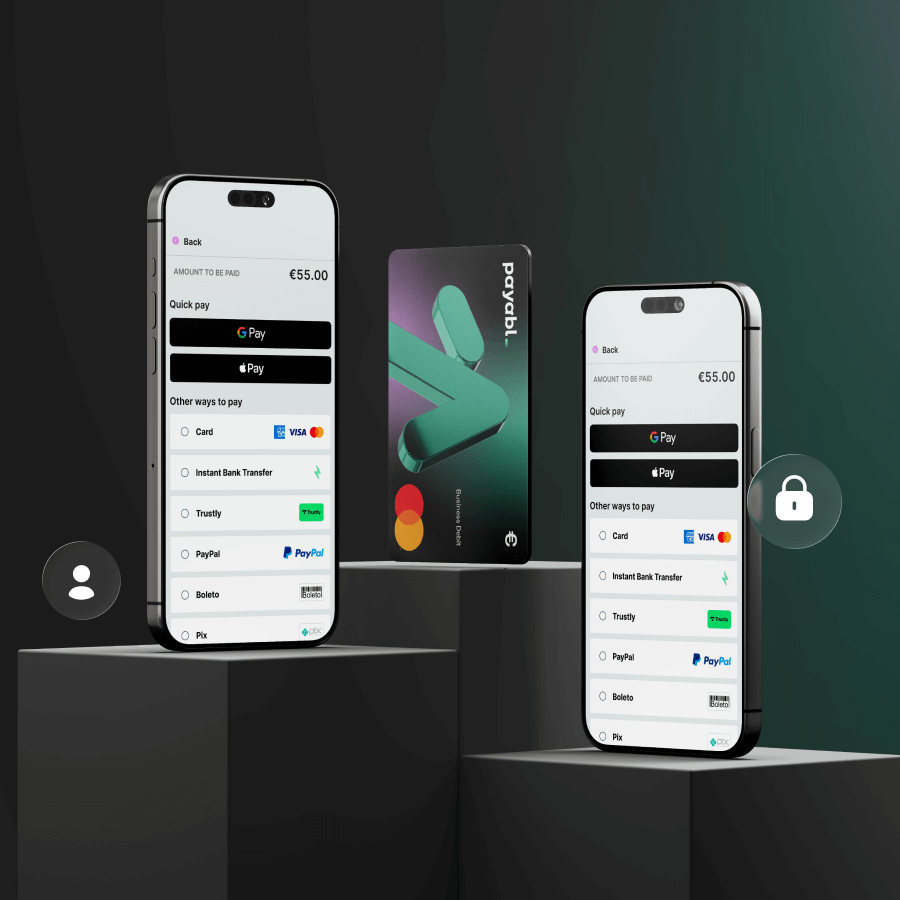

Which gateway you choose to integrate can impact the variety of payment methods you can offer to customers. The integration manages transaction details entered by your customers and oversees the secure transfer of this information to the appropriate payment processor and bank.

Key payment gateway integration goals

The goal of any online payment gateway integration is two-fold: to accept online payments efficiently and to make the user experience as seamless as possible. Businesses want payment gateway solutions that allow customers to securely enter their payment information and complete checkout quickly.

[Infographic]

However, to achieve these goals of efficient payment acceptance and a streamlined user experience, you’ll need to break things down even further:

- Trust & security: Protecting sensitive payment data through advanced cybersecurity measures, like encryption and tokenization, is essential. The more efficient and secure payments you complete, the greater customers’ trust in your business will grow.

- Optimised payment flows: Conversions can often depend on simplicity. A payment gateway should not only offer support for multiple payment methods and currencies, but also make it intuitive for the customer to select their preferred methods.

- Scalability: Your payment gateway solution must be able to grow with your business. When choosing a gateway integration service, it’s necessary to pay attention to each gateway’s ability to support increasing transaction volumes in both a secue and customer-friendly way.

We’ll discuss each of these additional goals more in time, so keep them in mind as we get deeper into the specifics of the payment gateway integration process.

Why payment gateway integration matters

Security, trust, and scalability are all vital benefits of payment gateway integrations, but they are far from the only reasons these integrations matter.

Without them, we would be unable to accept digital customer payments or any online payments at all. And for ecommerce, the online payment gateway integration process is also a necessity for growth.

The European E-Commerce Report 2024 shows that the industry has established particularly strong roots in Western Europe, with 82% of consumers participating in online shopping in 2023. Other regions in Europe have similarly high percentages, with none falling below 50%.

A well-integrated payment gateway protects sensitive payment information and meets your specific business needs while simultaneously transmitting that data to the appropriate processors and banks.

Types of payment gateway integrations

The quality of your payment gateway integration depends on the reliability of your payment gateway provider. Below are the three main types of payment gateway integrations offered by providers, along with important considerations to assess before making your choice.

Overview:

| Integration type | Description | Advantages | Disadvantages | Who should use it |

| Hosted payment gateway | Redirects customers to complete payments on an external site or window | Simplified setup, compliance, and security. | Limited control over branding and potential friction in the customer journey due to redirects. | Small businesses and startups in need of an easy and fast payment gateway integration. |

| API-based payment gateway | Connects a payment gateway to a merchant’s online storefront via an API, creating an embedded payment experience. | Greater customization and control over branding, as well as more support for payments from multiple devices. | Requires a well-built financial infrastructure, or alternatively, a partnership with a reliable payments platform that supports APIs. | Can benefit companies of all sizes but especially mid-to-large-sized companies seeking more customization. |

| Direct POST | Allows merchants to capture card data directly from the customer’s browser and transfer it to a hosted payment page. | Keeps customers on-site without needing to fully integrate an API-based embedded payment solution. | Imposes some PCI compliance responsibility on the merchant and provides less overall flexibility and payment methods. | Growing businesses or enterprises in need of control but not necessarily a custom-built solution. |

Hosted payment gateways

With a hosted payment gateway, the payment gateway provider manages the checkout process on external hosted payment pages. Rather than collect sensitive data directly from your site or app, hosted payment gateways redirect the customer to a secure and separate page to enter their information.

Hosted payment gateways are one of the most popular solutions among ecommerce businesses, as they offer a high level of simplicity in both ease of use and integration. The provider often assumes responsibility for fraud prevention as well, further streamlining the payment process.

Embedded gateways & payment gateway APIs

A payment gateway integration API allows you to process online payments and embed the entire checkout process directly on your website or app. Unlike redirect options, API-based solutions offer integrated payment gateways that keep customers on your page throughout the entire transaction.

Choosing a payment gateway API integration creates a more seamless and branded experience that does not disrupt the customer experience by redirecting them elsewhere. With an integrated payment gateway, you can customise the solution more freely with features like editable checkout forms.

Direct POST

Direct POST is a solution that allows you to capture card data directly in the customer’s browser with your own card form. This data is then passed straight from the browser to a hosted payment page, where it can then be transmitted to the payment processor.

Integrating a payment gateway through a direct POST solution can offload certain security and PCI compliance responsibilities that may otherwise increase your costs and operational complexity. Merchants choose this option for its ability to balance ease of implementation with flexibility.

Choosing the right payment gateway for your business needs

Most important part of content, use bullets and/or a consideration checklist sidebar

Selecting the right payment gateway is one of the most vital decisions for any company looking to accept online payments. The gateway you choose must align with your business needs and ensure that each payment passing through your system is both secure and cost-effective.

Most important considerations:

- Does the payment gateway integration website offer a simple implementation process?

- Can the solution you choose ensure a secure payment gateway integration?

- What is the cost of payment gateway integration, and is it transparent?

- Does the solution offer support for recurring payment use cases?

Every merchant has unique business needs. The provider you choose to partner with should have a willingness to adapt to your specific goals. A smooth online payment gateway integration is the first step to establishing a broader financial infrastructure supporting your business from behind the scenes.

As you research different providers, consider the following five factors:

Integration ability

Simplicity is crucial when integrating a payment gateway into your existing systems. Modern businesses rely on integrated payment gateways that offer APIs, SDKs, and plugins for popular platforms like WooCommerce, Shopify, or Magento. For example, if you’re looking for an ecommerce payment gateway integration, it should ideally be plug-and-play.

It’s equally important to consider the mobile payment gateway integration. Without mobile capabilities, a solution cannot guarantee convenient and quick payments on mobile devices.

Security & PCI DSS compliance

No matter the size of your business, protecting customer data during online transactions is non-negotiable. A trustworthy payment gateway will meet the highest security standards, including PCI DSS compliance.

Strong encryption or tokenisation mechanisms, fraud detection tools, and advanced authentication methods are essential components to a secure payment gateway. When evaluating your options, ask whether it provides built-in compliance tools and can reduce your overall risk exposure.

Costs & transaction fees

Pricing is another factor that directly impacts your bottom line. You don’t want the costs of your payment gateway to outweigh the benefits of accepting online payments.

As you compare different solutions, you need to ask detailed questions like:

- How much are the transaction fees?

- Do integrated payment gateways add hidden charges?

- What is the total cost of payment processing, including potential costs from cross-border payments or chargebacks?

Transaction fees can vary depending on card type, region, and volume, so always assess potential costs not just on the solution’s base price but also on regional cost considerations.

Scalability & supported payment methods/currencies

As your company grows, you’ll need a payment gateway that can scale with you. This can be especially true for subscription businesses that rely on seamless recurring billing, while global merchants must focus on adding support for multiple payment methods and currencies.

The providers you choose for not just your payment gateway but also for payment processing should help you route payments according to the most competitive transaction fees and the highest chances of success. Local payment support is also key so that your customers can pay according to their preferences.

Customer support and reliability

Never underestimate the value of responsive customer support.

Technical issues with your payment gateway can quickly affect revenue and customer satisfaction. A provider with 24/7 availability, clear documentation, and proactive communication gives peace of mind.

Since a payment gateway is at the heart of your online revenue flow, reliability is just as important as features or pricing. Always check uptime guarantees and performance benchmarks before committing.

For example, payabl.gateway comes with dedicated support from payments experts committed to solving your biggest payment problems and challenges. View our documentation here.

Step-by-step payment gateway integration process

The online payment gateway integration process comes with several core technical and operational steps.

Below is a step-by-step guide on how to select, implement, and manage a payment gateway integration:

Step 1: Requirements for payment gateway integration & payment processors

A clear plan for online payment gateway integration is essential.

Before you begin integrating a payment gateway, you need to establish a strong foundation. Understanding how payment data flows through your systems and ensures that your infrastructure and the solutions you choose are capable of supporting payment processing at scale.

You must also select the right payment processor, as this partner will manage the authorization and settlement of transactions. Depending on your business, you may need multiple payment processors to handle different regions or currencies.

Step 2: Selecting a gateway & setting up your merchant account payment information

Once you’ve chosen a payment gateway, the next step is to configure your merchant account.

A merchant account is tied directly to the funds collected through the gateway and is where the money is received after a transaction is approved and settled. During the setup of this account, you must make sure your business information is accurate and compliant.

Your chosen payment gateway should support a wide range of payment methods, including both traditional credit and debit cards, as well as alternative payment methods that are growing in popularity, like bank transfers and digital wallets.

Step 3: Obtaining API keys & access credentials

After setting up your merchant account, your provider will issue your API keys and login credentials. These are required for connecting your application to the payment gateway and payment processing.

API keys act as secure identifiers, allowing your system to authenticate requests with the provider’s servers. A payment gateway typically offers both test and production credentials so that developers (internal or external) can experiment safely before deployment. Proper handling of these credentials is critical, as unauthorised exposure of your keys could put transactions and sensitive data at severe risk.

Step 4: Front-end & back-end integration implementation

Now comes the technical work of integrating a payment gateway into your system.

Both the front-end (customer-facing checkout pages) and the back-end (server logic, database connections, order management) must be configured correctly.

A payment gateway typically provides SDKs, plugins, or sample code to simplify this process.

On the front-end, focus on responsive design. Your checkout forms should be intuitive and optimised for a fast checkout process. Your back-end configuration should have the capabilities to confirm transaction logs, error handling, and other critical functions are working properly.

Step 5: Testing in sandbox (don't forget about mobile payment gateways)

Before going live, run your payment gateway through testing in a sandbox environment that simulates real-world transactions without moving actual funds.

Ideally, your chosen payment gateway integration should also provide tools for testing different payment details and scenarios, including failed payments, chargebacks, and refunds.

During the testing stage, you also need to evaluate the experience on both desktop and mobile platforms. Customers expect smooth support from mobile payment gateways, so your integration of choice needs the ability to deliver equally efficient and secure checkout experiences via mobile channels.

Step 6: Going live & deployment

When testing is complete, it’s time to transition to production and launch your secure payment gateway. This step requires following a careful deployment workflow:

- Switch from sandbox API keys to live credentials.

- Ensure all production systems are protected with strong encryption and monitoring tools.

- Double-check that the payment gateway is processing correctly across all supported channels.

Step 7: Post-launch support & monitoring

Integration doesn’t end at deployment.

Continuous monitoring and management is the key to keeping your payment gateway reliable and effective. Regularly track performance metrics such as authorisation and transaction success rates. If and when issues arise, you want a payment gateway provider you can trust as a source of support.

Common pitfalls of payment gateway integrations

- Security misconfigurations and compliance oversights in a payment gateway can expose sensitive payment details to fraud attempts and bad actors.

- A poor user experience or slow checkout process can delay payment processing and reduce transaction completion rates in your payment gateway.

- Gaps in testing may leave issues with customer data or payment handling undetected, affecting overall performance of the payment gateway.

Best practices for a successful integration process

- Implement a payment gateway solution that offers advanced fraud and security tools for protecting payment details in the payment gateway.

- Streamline checkout for fast, mobile-friendly experiences to improve payment processing and transaction completion.

- Conduct comprehensive testing to secure customer data and ensure a reliable payment gateway.

Estimating time, cost, and required skills

Integrating a payment gateway requires careful planning across three key categories:

- Time: Typical integration projects range from 2–5 months, with simpler hosted or plugin-based setups on the shorter end and custom solutions taking longer.

- Cost: Standard payment gateway integration costs range from USD 20K to 100K, while fully custom gateways can exceed 100K USD, accounting for development, testing, and security measures. Accurate budgeting ensures resources are allocated without surprises.

- Required skills: Deciding between an internal team or external vendor depends on expertise. In-house developers may lack specialized skills, while external vendors bring experience with multiple payment gateway solutions, speeding delivery and ensuring compliance.

Conclusion & next steps

At payabl., we make money flow seamlessly across devices and channels. Our payabl.gateway solution gives you the freedom to build a custom checkout with pre-built plugin integrations, one-click payments, and an optimised hosted payment page.

Through our advanced platform and with the help of our dedicated support teams, you can gain total command over the flow of your funds. Contact us now to get started.