In an attempt to solve this issue, a number of technology providers are investigating payment orchestration – using an additional technology layer to simplify the payment process, allowing merchants to manage the payment transaction, routing, and settlement process through a single platform.

Here we investigate whether payment orchestration could become a key capability for merchants, the potential benefits it could provide as well as the challenges it could present in practice.

What’s the big idea behind payment orchestration?

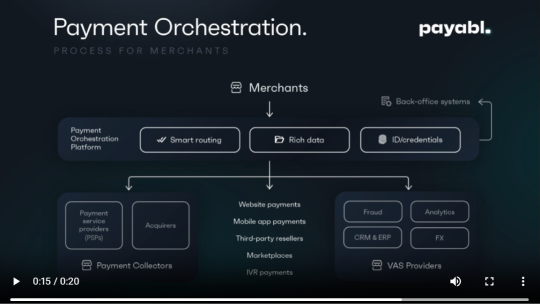

Payment orchestration is a technology-driven approach to solving payment complexity, using a holistic platform that combines multi-provider integration, intelligent assistance and data management. A payment orchestration layer (POL) enables merchants to work with multiple tools and partners, without having to separately integrate with each one of them, reducing integration costs, time to market and single-party risk, while expanding choice. AI-enabled platforms can progressively optimise transaction routing to find more efficient, reliable and fast routes for payments – a practice known as smart or dynamic routing.

POLs can aggregate the data from the multiple payment providers to provide less fragmented, more unified reporting for payments strategy formulation.

These systems would automatically decide the best way to route a payment from checkout through to bank settlement, increasing the payment conversion, streamlining the payment journey and, in theory, making more money for merchants. However, the routing logic – the rules and criteria for the routing – would have to be selected by the merchant themselves. The success of the platform implementation would largely depend on the quality of the logic input.

For businesses working on an international scale, this has the potential to simplify the payment process – the merchant only needs to interact with a single tool, which allows them to manage the flow of payments through the necessary issuers, acquirers, PSPs and networks to facilitate rapid, secure transactions.

In principle, this could answer many of the challenges facing merchants, but it also brings its own questions. Below is an animated diagram of how the payment orchestration process works.

Is payment orchestration really necessary for merchants?

Companies of all sizes and sectors – B2C, D2C, B2B – all over the world are moving online, with global e-commerce growing another 16.5% in 2020. Meanwhile, 72% of SMEs are using web-based payment platforms from banks, money transfer companies and other providers, and approximately two-thirds are using mobile apps. A payment orchestration layer (POL) has the potential to consolidate a company's payment data and tools into a single stack, connecting with the rest of their digital network to try and solve the key issues facing merchants operating in a multiple payment solution provider ecosystem.

Complex global payments

58% of SMEs say they are sending and receiving more cross-border payments now than they were before the pandemic. That’s a significant increase from 2020, when 38% surveyed said they had increased their use of cross-border payments since the pandemic began. Payment orchestration could potentially provide a central location to interact with all the necessary issuers and acquirers in all the markets a merchant might operate, while ensuring the necessary compliance of tracking customer data and tracking tax and VAT data. However, this would require significant investment on the part of POLs to build and maintain the necessary connections and solve existing licensing issues.

Digital risk is growing

The increasingly complex payment journey for digital payments opens the door to increased risk of fraud and security breaches. 20% more businesses noticed an increase in online payment fraud in 2021 than the previous year, while 55% of businesses say they worry about both fraud and data security when receiving international payments.

Businesses balancing multiple payment platforms and providers are more at risk of error or fraud due to the complex task of checking and tracking transactions. A POL centralises tracking and visibility in a single place, with the potential to set up automated controls based on AI and ML algorithms that can spot suspicious transactions. In addition, POL also enables the integration of fraud prevention tools into the ecosystem to catch threats proactively.

The challenge for POLs is to ensure robust security for their platforms. Unauthorised access to the platform would also expose the whole payment network to bad actors.

Delivering on customer expectations

In the digital age, consumers expect their online retail experiences to match the convenience and usability standards set by online leaders such as Amazon, as well as other digital services, setting a high bar for merchants to clear. Customers expect personalised experiences for payments, matching payment methods and timelines to their needs, which can require merchants to manage and integrate multiple payment tools. Payment orchestration enables merchants to offer more payment methods – a growing trend – to the checkout experience, including alternative payments such as cryptocurrency and virtual cards, through a single platform, reducing integration workloads and simplifying payment portal management.

Unreliable payments can lose merchants money

Any reliance on third-party providers is a risk for merchants, especially when it comes to payments. Over reliance on a single payment provider can leave a business exposed in the instance of an outage, unable to process payments and receive revenue. In principle, a POLs can connect merchants to a wider range of payment providers and methods, even rerouting payments through a more secure gateway if the AI foresees an issue, which can reduce decline rates and boost sales.

This will put significant pressure on POLs to maintain uptime and reliability, with a need for flexible architecture that can accommodate multiple payment routes, rerouting payments if a node goes down. However, if the POL itself experiences an outage, the merchant will be cut off from all their payment gateways –meaning there will always be an element of risk for merchants. The potential challenges of payment orchestration For mass-market payment orchestration to become a reality, there are several challenges POL providers must overcome, and even then there is a question about at what scale payment orchestration becomes necessary.

Firstly, POLs must be able to onboard the necessary providers and build the rails required to send payments more efficiently. If all POLs do is aggregate all existing systems, then it will also take on the same risks and limitations – if your single provider for payments to, say, Malaysia increases charges, you may be stuck with that option. There is also an open question about to what extent providers will want to lose control of the customer journey by integrating with POLs.

Solving this issue, to facilitate multiple payment formats, front-end interfaces and accounts will be a significant technical challenge for payment orchestration platforms. In the meantime, new initiatives such as tokenisation from existing payment solutions may render these tools less crucial. More challenging may be regulation. The EU’s PSD2 and SCA (strong customer authentication) rules require payments to meet certain criteria and present a challenge to the end customer. This may happen at multiple points along the journey, forcing the customer to complete multiple checks. Software platforms can use third party 3DS service providers but the payment gateway may not accept or want to work with them. Will payment orchestration really revolutionise payments?

Payment orchestration platforms are certainly a promising route to efficiency and convenience – merchants have the chance to optimise their payment processing flows, resulting in lower integration costs, higher conversion rates, easier processing costs and smart routing to better serve global customers. However, consolidation also comes at a cost.

While working with multiple providers can be inefficient, it also spreads risk. Moving to a single provider for your connection to multiple payment solutions puts all your eggs in a single basket. If that POL experiences an outage, then the route to those providers is also cut off. The ability of POLs to manage the whole experience will likely also be more collaborative than currently touted. Optimising approval rates, for example, will still require merchants to determine the transaction routing strategy and review its performance to find the most effective options. As global business becomes increasingly normalised for small and large businesses alike, there will be a need for low-cost, flexible, intuitive systems to manage integration costs and workflows for merchants. However, these transitions will always carry a measure of risk, especially in the early days of their development.

What the rise of payment orchestration makes clear, however, is that payments are now a key competitive competency for merchants online, in terms of efficiency, experience and risk. Whether payment orchestration will be an answer to what seems a highly fragmented payments landscape remains to be seen, but the investigation could lead to exciting new possibilities going forward.