- Half of UK retailers are considering scaling back or closing in 2026, new research finds, as rising fraud erodes margins, disrupts operations and undermines confidence.

- Fraudulent returns and refunds are now the most common fraud types threatening retailers, followed by card fraud and chargeback or “friendly” fraud.

- Fraud is damaging company brands and customer relationships alongside finances, with retailers reporting major reputational harm and a decline in loyalty.

15th January 2026, London: Rising fraud is putting significant pressure on UK retailers, with half of businesses at risk of closing or scaling back in the year ahead, new research finds.

The research from leading European financial technology provider payabl.’s Fraud in Europe report shows that the impact of fraud on retailer operations, margins and customer trust has become so significant that 48% of retail leaders have actively considered closing or scaling back their operations.

While financial losses from fraud remain significant – costing UK businesses £1.17 billion in 2024, according to UK Finance – the wider impact on merchants and the consumers they serve is becoming increasingly severe, as overall UK business confidence continues to deteriorate, according to the ICAEW.

Overall, 36% of retailers reported a direct loss of income due to fraud. While this is the most explicit impact, retailers are also experiencing other significant repercussions from fraudulent activity. More than half of retailers (52%) say fraud has caused reputational damage to their company’s brand, rising to 67% among larger businesses, and 21% say fraud and scams have already negatively impacted customer loyalty.

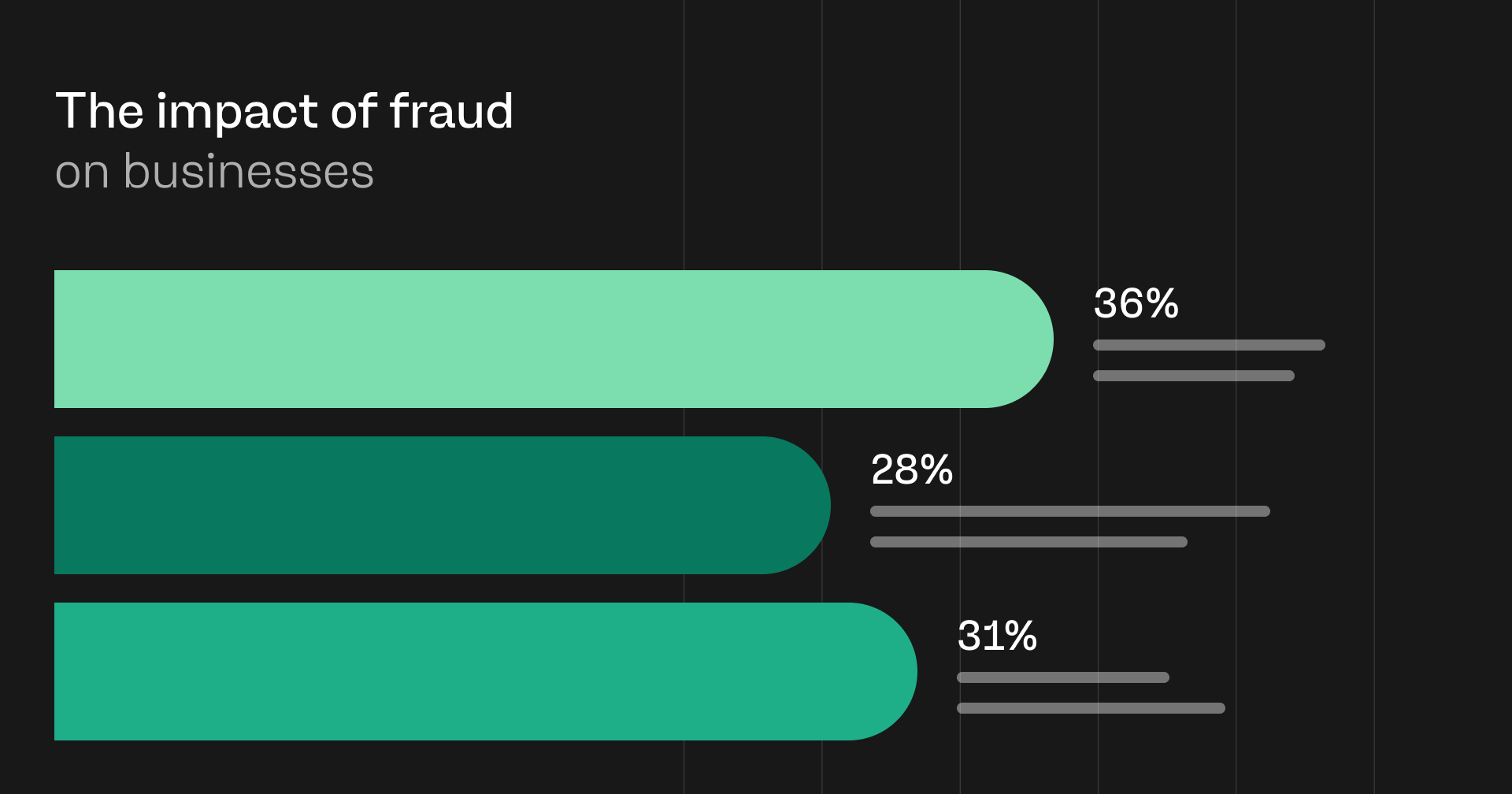

When asked about the types of fraud they are facing most frequently, retailers cited fraudulent returns and refund fraud (44%) as the leading issue, followed by fraudulent purchases using stolen payment details (36%) and chargeback or “friendly” fraud (31%).

As retailers plan for 2026, the responsibility of tackling fraud is weighing heavily on decision-makers. More than eight in ten (84%) say they feel responsible for preventing fraud, while 74% say they are spending more time and resources combating fraud than they were a year ago.

Ugne Buraciene, Group CEO of payabl., said: “As we enter 2026, the threat of fraud is firmly on the minds of business leaders, and is now actively shaping decisions about growth and even continued operation.

“Our research shows that many merchants are spending more time, money and energy fighting fraud than ever before, yet still feel exposed and unsupported. Business leaders are willing to invest and take responsibility, but fraud has become too complex and too fast-moving for many to tackle alone.

“Without stronger coordination between banks, governments, payment providers and online platforms, fraud will continue to dent business confidence and hinder UK economic growth in 2026.”

The report findings come during a period of rising business closures across the UK. Insolvency Service data shows 25,840 company insolvencies between January and November 2025, continuing an upward trend seen over the past several years. While insolvency is driven by multiple factors, the growing impact of fraud is compounding existing financial pressures.

Despite the scale of the challenge, the clear majority (87%) of retailers believe tackling fraud is critical to their long-term success, with 76% planning to increase investment in fraud prevention over the next 12 months. However, retailers don’t believe they can tackle the problem alone. Nine in ten (88%) say banks must do more, and 84% say the government must set out where responsibility for tackling fraud lies.

To better help customers to stay safe from fraud, payabl., last year, announced its partnership with Sift, an AI-powered fraud prevention platform, giving merchants a seamless way to combat fraud, cut chargeback rates and improve approval rates, without adding friction to the customer journey.

Oleg Stefanets, Chief Risk Officer, payabl., said: "Fraud, and chargebacks in particular, continue to give merchants a major headache. There are steps businesses can take to reduce their threat, however, such as clearly communicating refund and cancellation policies at checkout and improving customer service so issues can be resolved before they escalate. Implementing advanced fraud controls is also crucial to identifying and blocking suspicious activity, preventing fraudulent purchases before they can lead to disputes."

ENDS

Methodology

Opinium Research, on behalf of payabl, surveyed 200 merchants serving European and UK markets between 11th and 22nd September 2025.

About payabl.

payabl. is a financial technology provider offering payments and business accounts for businesses of all sizes, enabling companies to accept online and in-person payments, manage multi-currency business accounts, issue virtual and physical cards, and access over 300 local and alternative payment methods. Combining in-house development with strategic partnerships, payabl. delivers secure, compliant, and scalable financial solutions that help businesses optimise operations and expand internationally. The company has offices in London, Amsterdam, Frankfurt, Limassol, and Vilnius. To learn more, visit: payabl.com