The retail sector is experiencing a fundamental shift in how consumers prefer to shop. Ecommerce and online sales have become the dominant growth and revenue channels for retailers, with 57% of merchants now prioritising online sales growth over markers such as expansion (37%) and reducing costs (41%) over the next 12 months. For small and medium-sized enterprises, this focus is even more evident, with 71% making online sales their top priority.

This digital focus reflects changes in broader consumer behaviours. Among larger merchants, 89% now operate through a combined online and physical model, while 22% of SMEs rely exclusively on online stores. The numbers underscore a clear reality for merchants; the future of shopping is online and ecommerce based, with retailers now adapting their strategies accordingly.

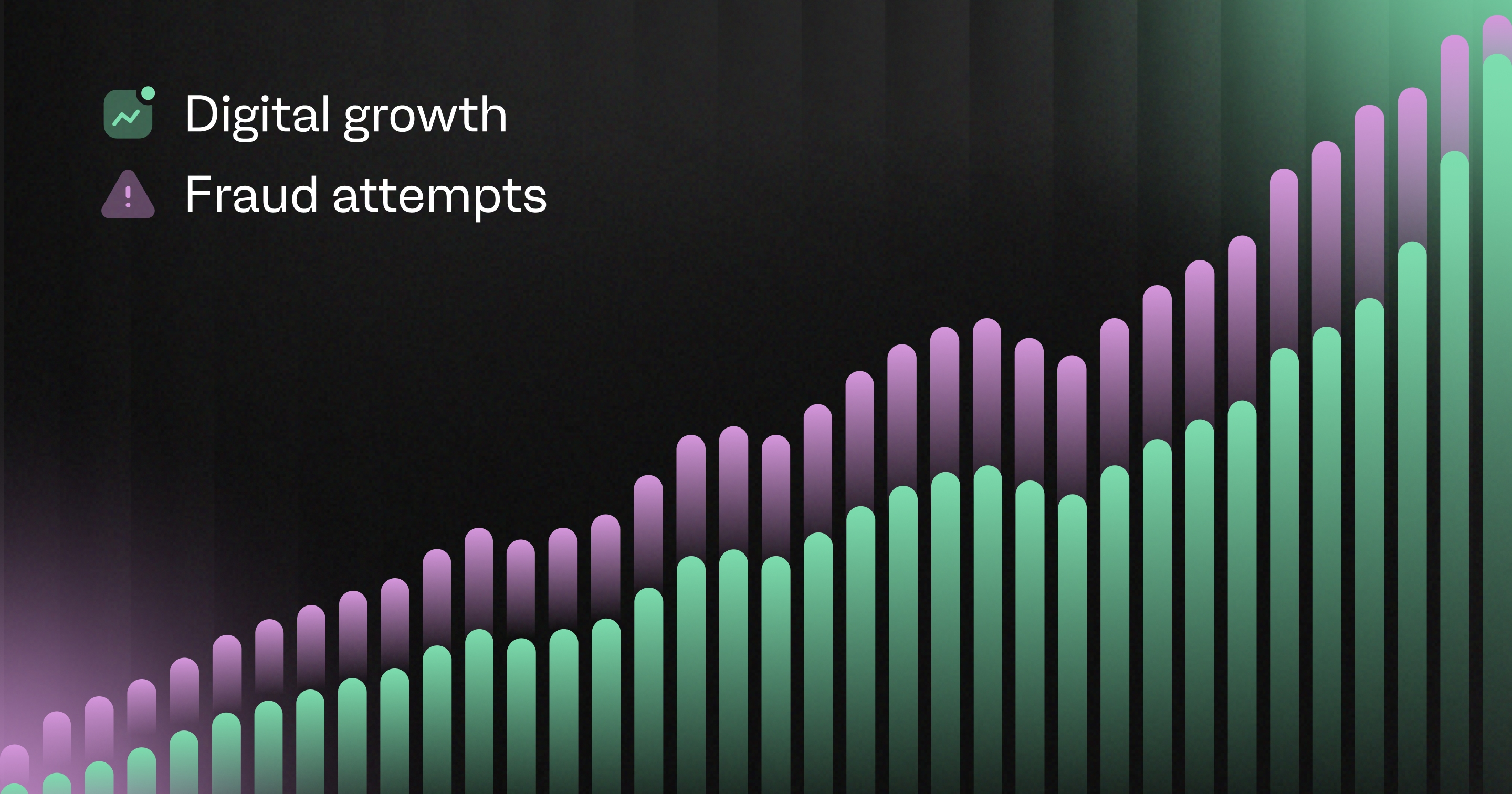

However, this transformation comes with a significant challenge, with risks increasing for merchants. As shopping preferences shift online, fraud attempts have escalated in parallel, creating new vulnerabilities that affect both businesses and consumers.

The fraud correlation

The link between digital growth and increased fraud risk has become apparent in recent data released in payabl.’s latest fraud report. The report reveals that over half (53%) of businesses report seeing a growing number of scam and fraud attempts over the past 12 months, a figure that rises to 64% among larger businesses. Consumers share this concern, with 47% noting an increase in fraud attempts during the same period.

The scale that victims are being affected by fraud is considerable too. Across all age groups (18-79+), 26% of consumers report having been a victim of fraud. This represents more than one in four shoppers who have experienced some form of fraudulent activity when shopping online.

The relationship between shopping online and fraud exposure becomes clearer when examining the different consumer demographics. Younger, more ‘online’ shoppers face the highest risk, with 38% of Gen Z respondents and 31% of Millennials reporting they have been victims of fraud.

Surprisingly, it’s these generations - who have grown up online and tend to complete more transactions online - and not older generations, who may be less versed online, that represent the most vulnerable segment of the market.

Consumer concerns across generations

The types of fraud that concern shoppers vary significantly by age too. Overall, 33% of consumers worry most about their credit or debit card details being stolen. Identity theft concerns 26% of shoppers, while 24% are wary of account takeovers, where a fraudster gains unauthorised access to their online account.

The older generation of consumers shows heightened concern regarding traditional fraud methods. Nearly half (46%) of Baby Boomers fear having their card details stolen, and concerns about compromised card details increase consistently with age. Among Gen X respondents, 26% express concerns about identity theft.

The younger generations also demonstrate greater awareness of emerging fraud techniques. Among Gen Z and Millennials respondents, 14% and 15% respectively worry about deepfakes and impersonation scams, while 11% are concerned about romance scams.

Additionally, 12% of Gen Z respondents have concerns about Authorised Push Payment fraud, a growing threat as real-time payment rails continue to grow in popularity.

Strategic responses to fraud

Recognising this growing threat, merchants are beginning to prioritise fraud prevention alongside their expansion efforts. One in four (28%) business leaders say they will focus on reducing the threat of fraud and theft in the next 12 months, while a third (34%) of business leaders are focused on adopting the latest payments technology. 24% of merchants plan to invest in improving their online checkout process.

These initiatives aim to balance the speed and convenience consumers demand with the security necessary to maintain trust. With this in mind, the challenge facing retailers is clear: growing in-store sales. This ranks as the lowest priority at just 24%, underscoring how digital channels have reshaped retail strategy.

How merchants manage the expectations that customers expect when shopping online with driving more sales in-store starts with implementing strong security measures in-place online, which is now many people’s first touchpoint with a retailer or brand. Generally, customers build trust and brand affinity first with merchants online, and complete in-store purchases once this has been established.

The importance of building trust

The overall data from the report reveals tension in modern retail practices. While online growth appears to be the future trend, it is creating fertile ground for fraudsters to operate. The businesses that succeed will be those that can offer the speed and flexibility shoppers demand, without compromising on trust and security at checkout.

Maintaining this trust has become one of the defining challenges of modern commerce for merchants. As fraud attempts continue to grow alongside online sales volume, retailers should look towards robust security measures that protect consumers — all without introducing friction into the shopping experience.

Alongside this, the 26% average fraud victimisation rate demonstrates that current measures are insufficient, and the disproportionate impact on younger, more online consumers suggests that new approaches are needed to tackle fraudulent behaviours.

This shift in shopping preferences feels somewhat irreversible. More of us are shopping on our phones than ever (59% of global ecommerce sales are completed on mobile devices), and the opportunities for growth remain lucrative if approached correctly. However, addressing the fraud risks that accompany this online migration will be essential for maintaining consumer confidence and ensuring the long-term viability of online retail.

Download ‘Fraud in Europe: Counting the cost for retailers and shoppers’ to find out more about how retailers can better tackle fraud and handle retail growth.