Smoother checkout'%3e%3cpath%20d='M157.793%2024.023h-.051c-2.5%200-4.644.94-6.193%202.57v-2.17h-5.862v28.019h5.862v-8.997c1.518%201.604%203.605%202.544%206.074%202.539h.051c2.981%200%205.501-1.111%207.226-3.074%201.73-1.962%202.644-4.709%202.639-7.901%200-3.199-.904-5.945-2.608-7.907-1.699-1.963-4.194-3.084-7.138-3.079Zm2.614%2015.16c-.77.81-1.979%201.272-3.879%201.277-1.922%200-3.14-.468-3.915-1.277-.775-.81-1.229-2.14-1.229-4.18%200-2.04.454-3.37%201.229-4.179.775-.81%201.993-1.272%203.915-1.277%201.9%200%203.109.462%203.879%201.277.769.81%201.229%202.139%201.229%204.18%200%202.04-.455%203.369-1.229%204.179ZM208.569%2037.22v.01l-.589%201.854-.547-1.812-4.385-12.85h-6.456l8.677%2022.574h-7.025v5.446h5.021c1.854%200%203.321-.307%204.493-1.106%201.172-.8%201.937-2.02%202.546-3.567l9.152-23.347h-6.461l-4.426%2012.798ZM266.436%2027.101c-1.699-1.962-4.194-3.084-7.138-3.078h-.051c-2.5%200-4.644.94-6.193%202.57V15.54h-5.862v30.038h5.862v-2.133c1.518%201.604%203.605%202.544%206.074%202.538h.052c2.98%200%205.5-1.11%207.225-3.073%201.725-1.963%202.639-4.704%202.639-7.897v-.01c0-3.193-.903-5.94-2.608-7.902Zm-4.519%2012.081c-.77.81-1.978%201.272-3.879%201.272-1.921%200-3.14-.467-3.915-1.277-.775-.81-1.229-2.139-1.229-4.18%200-2.04.454-3.369%201.229-4.178.775-.81%201.994-1.272%203.915-1.278%201.901%200%203.109.462%203.879%201.277.769.81%201.229%202.14%201.229%204.18%200%202.04-.46%203.37-1.229%204.18v.004ZM278.341%2039.691V15.54h-5.862v25.034c0%202.762%202.231%205.004%204.979%205.004h4.416v-5.892h-3.533v.005ZM190.673%2024.423c-1.824%200-3.383%201.085-4.101%202.642-1.576-1.936-3.895-3.047-6.637-3.042h-.057c-2.923%200-5.407%201.116-7.102%203.079-1.699%201.962-2.603%204.708-2.603%207.901%200%203.198.915%205.945%202.645%207.907%201.725%201.963%204.245%203.079%207.225%203.074h.052c2.438%200%204.514-.914%206.033-2.492v2.087h5.862V30.315h2.153v-5.892H190.673Zm-5.578%2014.754c-.775.81-1.994%201.272-3.915%201.278-1.922%200-3.13-.462-3.889-1.272-.765-.805-1.214-2.14-1.214-4.18%200-2.045.449-3.374%201.214-4.179h.005c.764-.81%201.967-1.267%203.889-1.272%201.921%200%203.14.467%203.915%201.277.775.81%201.229%202.14%201.229%204.18%200%202.04-.454%203.369-1.229%204.179l-.005-.01ZM240.111%2024.423c-1.824%200-3.383%201.085-4.101%202.642-1.576-1.936-3.895-3.047-6.637-3.042h-.057c-2.923%200-5.408%201.116-7.102%203.079-1.699%201.962-2.603%204.703-2.603%207.896v.01c0%203.193.915%205.94%202.645%207.902%201.725%201.963%204.245%203.079%207.225%203.074h.052c2.438%200%204.514-.914%206.033-2.492v2.087h5.862V30.315h2.153v-5.892H240.111Zm-5.578%2014.754c-.775.81-1.994%201.272-3.915%201.278-1.922%200-3.13-.462-3.89-1.272-.764-.805-1.213-2.14-1.213-4.18%200-2.045.449-3.374%201.213-4.179.765-.81%201.968-1.267%203.89-1.272%201.921%200%203.14.467%203.915%201.277.774.81%201.229%202.14%201.229%204.18%200%202.04-.455%203.369-1.229%204.179v-.01Z'%20fill='%23000'/%3e%3cpath%20d='M301.066%2039.686h-10.603c-1.503%200-2.918%201.028-3.13%202.518a2.943%202.943%200%200%200%202.903%203.374h10.603c1.503%200%202.918-1.027%203.13-2.517a2.943%202.943%200%200%200-2.903-3.375Z'%20fill='url(%23b)'/%3e%3c/g%3e%3cpath%20d='M118.923.971v65.074'%20stroke-width='.862'%20stroke='%23000'/%3e%3cg%20clip-path='url(%23c)'%3e%3cpath%20d='M60.324%2016.87H39.647v37.154h20.677V16.871Z'%20fill='%23FF5F00'/%3e%3cpath%20d='M40.96%2035.447c0-7.221%203.347-14.113%208.992-18.577-10.24-8.074-25.14-6.302-33.214%204.004-8.009%2010.24-6.236%2025.075%204.07%2033.15a23.569%2023.569%200%200%200%2029.21%200%2023.642%2023.642%200%200%201-9.058-18.577Z'%20fill='%23EB001B'/%3e%3cpath%20d='M88.222%2035.447c0%2013.062-10.568%2023.63-23.631%2023.63-5.317%200-10.437-1.772-14.573-5.054%2010.24-8.074%2012.013-22.909%203.939-33.215-1.182-1.444-2.495-2.822-3.939-3.938%2010.24-8.074%2025.141-6.302%2033.15%204.004%203.282%204.136%205.054%209.256%205.054%2014.573Z'%20fill='%23F79E1B'/%3e%3c/g%3e%3cdefs%3e%3cclipPath%20id='a'%3e%3cpath%20d='M145.687%2015.54H304v36.907H145.687z'%20fill='%23fff'/%3e%3c/clipPath%3e%3cclipPath%20id='c'%3e%3cpath%20d='M0%200h100.038v70.893H0z'%20fill='%23fff'/%3e%3c/clipPath%3e%3clinearGradient%20gradientUnits='userSpaceOnUse'%20y2='42.635'%20y1='42.635'%20x2='290.256'%20x1='306.381'%20id='b'%3e%3cstop%20stop-opacity='0'%20stop-color='%237CDDAE'/%3e%3cstop%20stop-opacity='.44'%20stop-color='%237CDDAE'%20offset='.41'/%3e%3cstop%20stop-opacity='.84'%20stop-color='%237CDDAE'%20offset='.82'/%3e%3cstop%20stop-color='%237CDDAE'%20offset='1'/%3e%3c/linearGradient%3e%3c/defs%3e%3c/svg%3e)

Convert more sales.

Keep customers happy.

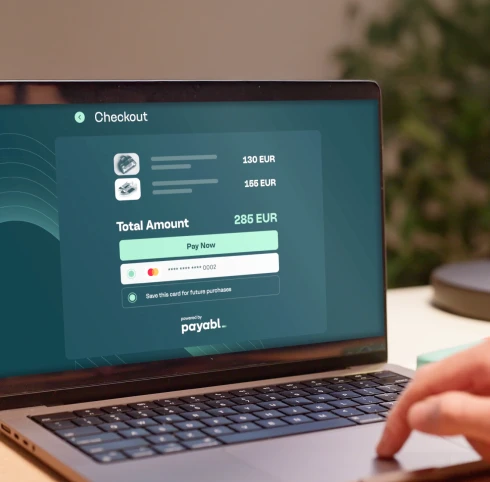

Friction at checkout costs you sales—and loyalty.

When customers scramble to find their card details or face manual entry hurdles, frustration (and checkout abandonment) skyrockets — and 43% won't return to an online retailer after a poor experience. *

*The state of European checkouts | payabl.| 2025

You need a faster, smarter way to close the sale.

Get in touch

Convert more sales.

Keep customers happy.

Friction at checkout costs you sales—and loyalty. When customers scramble to find their card details or face manual entry hurdles, frustration (and checkout abandonment) skyrockets — and 43% won't return to an online retailer after a poor experience.* You need a faster, smarter way to close the sale.

*The state of European checkouts | payabl.| 2025

Customers expect speed.

Checkout complications shouldn’t slow them down.

With tokenization, powered by Mastercard, transactions are easy, fast and secure. Sensitive card data is replaced with a unique, random, and secure token. This token is used for transactions, making it harder for fraudsters to access customer information, and reducing the chances of customers making manual errors.

Secure, one-click payments.

No digging required.

Stable revenue. Stronger security.

The 'save card' feature doesn’t just boost customer satisfaction—it protects your bottom line. Reducing manual entries means fewer errors, chargebacks, and false declines. Enhanced security builds trust and drives repeat business.

2% average increase in approval rates for tokenized transactions compared to non-tokenized ones.

A complicated checkout process is a major reason for cart abandonment, with 17% of shoppers citing it as a reason for leaving a cart. *

(*Hotjar | 2025)

Don’t let outdated payment processes cost you your next customer.