business accounts that mean business '%20d='M42.8667%200H9.84112C5.15994%200%20.75225%203.14009.0927%207.69163-.69554%2013.2423%203.64781%2018%209.13331%2018H42.1589c4.6812%200%209.0889-3.1401%209.7484-7.6916C52.6955%204.75771%2048.3522%200%2042.8667%200Z'/%3e%3cdefs%3e%3clinearGradient%20id='a'%20x1='59.4197'%20x2='9.19766'%20y1='9.00793'%20y2='9.00793'%20gradientUnits='userSpaceOnUse'%3e%3cstop%20stop-color='%237CDDAE'%20stop-opacity='0'/%3e%3cstop%20offset='.41'%20stop-color='%237CDDAE'%20stop-opacity='.44'/%3e%3cstop%20offset='.82'%20stop-color='%237CDDAE'%20stop-opacity='.84'/%3e%3cstop%20offset='1'%20stop-color='%237CDDAE'/%3e%3c/linearGradient%3e%3c/defs%3e%3c/svg%3e)

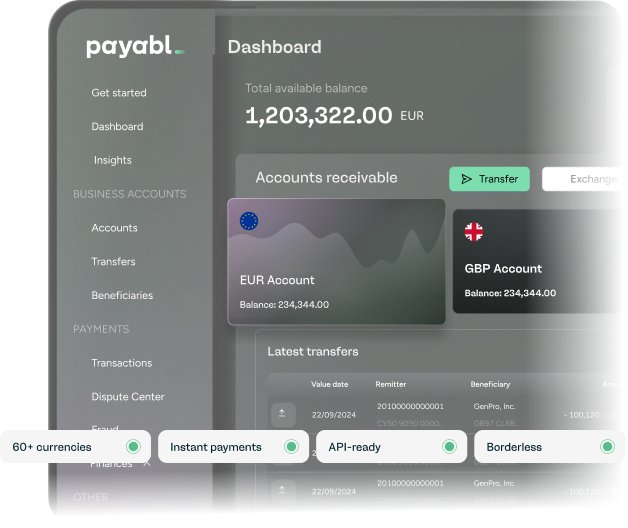

Multi-currency IBANs, instant transactions, card issuing, and real-time financial control.

Simplify finances with a multi-currency business account

Effortless global expansion

Navigate global payments and markets confidently with business accounts and banking solutions built for scale. With 24/7 foreign currency accounts.

Real humans on hand

A dedicated contact to resolve issues, correct typos, and expedite payments to and from your multi-currency account.

Multi-currency IBANs

With foreign currency support, open multi-currency business accounts with payabl. to receive, hold, and send global payments in EUR, GBP, USD, and 27 more.

Built for speed, simplicity, and security

No more late transfers and stuck payments. Say goodbye to data discrepancies, hidden fees, and expansion inflexibility. With a payabl. multi-currency business bank account, you get:

payabl. virtual cards

Your smart, automated, and compliant expense management tool that enhances financial control, simplifies processes, and optimises corporate spending.

Instant corporate cards

Issue cards for employees and departments for controlled spending. Connect them all to your multi-currency accounts for simplified currency conversion.

Real-time spend tracking

Monitor transactions across your multi-currency accounts and international transfers in different currencies as they happen. Set transaction limits to control corporate spending.

Custom spending limits

Set caps and control expenses effortlessly with our four-eyes principle and joint signature levels.

Global transactions simplified

Our multi-currency accounts and cards support local and global payments in multiple currencies.

Seamless, secure spending

Backed by payabl.’s trusted financial ecosystem and bank account solutions.

An intuitive user experience

Mastercard business debit card compatible with Apple Pay and Google Pay.

Cards & business accounts for every corporate use case

Don't take our word for it

Why open a payabl. business account?

One provider, one platform

From accepting payments in different currencies to managing your business finances and foreign exchange strategy, everything is integrated on payabl.one.

Fast and easy onboarding

A fully digital process to get your multi-currency account set up quickly. We handle complex tasks like currency exchange so you can focus on your business operations.

Enterprise-grade security

Protect your multi-currency account and foreign exchange data. Our global accounts enable secure international transactions and a safe environment for holding multiple currencies.

Scalable multi-currency account for business

Whether you’re a startup, scale-up, or established business, our multi-currency accounts cover all your bases — no need for separate accounts.

Virtual cards on demand

Global accounts and cards that streamline expense management and enhance liquidity for your business. Send money to different countries and receive funds from international customers.